African Bank Credit Card Application Requirements

Navigating the world of credit cards can feel like venturing into a new terrain, especially in the diverse landscape of African banking. Understanding the application requirements is the first step towards financial empowerment. Whether you’re a seasoned globetrotter or a first-time applicant, this comprehensive guide will equip you with the essential knowledge to confidently apply for an African bank credit card.

Filling out an African Bank Credit Card Application

Filling out an African Bank Credit Card Application

Essential Documents for Your Application

Generally, African banks require a standard set of documents to assess your creditworthiness. These documents provide a snapshot of your financial history and help the bank determine your eligibility.

- Proof of Identity: A valid passport or National ID card is crucial for identity verification.

- Proof of Residence: A recent utility bill (electricity, water, or telephone) bearing your name and address serves as proof of residence.

- Income Verification: Banks need assurance of your ability to repay credit. This typically involves submitting recent payslips (usually three months’ worth) or bank statements reflecting your income. For self-employed individuals, providing proof of business ownership and income statements might be necessary.

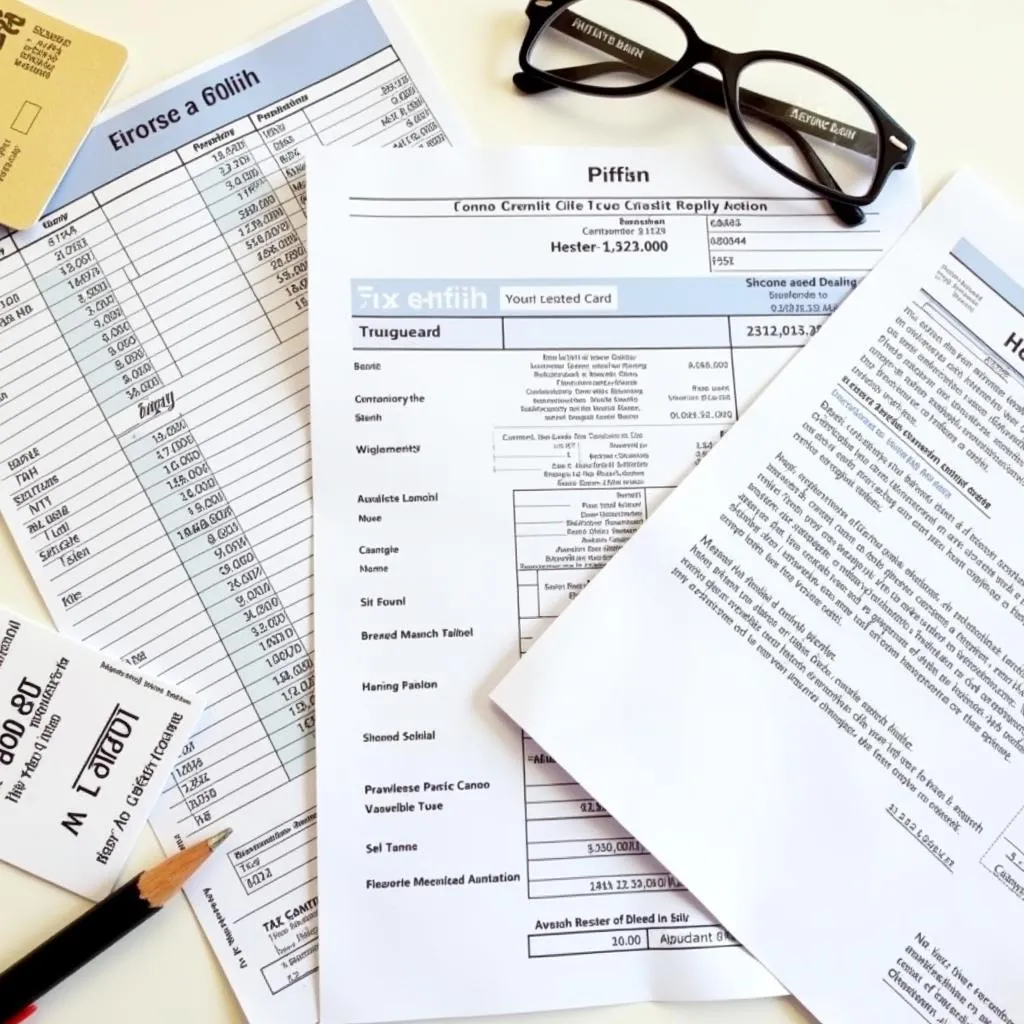

Proof of Income Documents for Credit Card Application

Proof of Income Documents for Credit Card Application

Meeting Eligibility Criteria

Each bank establishes specific eligibility criteria that applicants must meet. While these criteria may vary slightly, common requirements include:

- Age Limit: You must typically be at least 18 years old, though some banks might have a higher age requirement.

- Credit History: A good credit history demonstrates responsible financial behavior and increases your chances of approval. However, some banks offer credit cards specifically designed for individuals building or repairing their credit.

- Minimum Income: Banks often set a minimum monthly or annual income requirement to ensure you can manage credit repayments comfortably.

Navigating the Application Process

The application process itself is designed to be straightforward. You can typically apply online, visit a local branch, or contact the bank’s customer service. During the application, you’ll be asked to provide personal and financial information.

Applying for a Credit Card Online

Applying for a Credit Card Online

Tips for a Successful Application

- Maintain a Healthy Credit Score: Before applying, request your credit report and address any discrepancies. A good credit score significantly enhances your chances of approval and can even lead to more favorable terms.

- Provide Accurate Information: Ensure all information provided on the application is accurate and up-to-date. Inaccuracies can delay the process or even lead to rejection.

- Manage Your Debt-to-Income Ratio: A healthy debt-to-income ratio signals financial responsibility. Aim to keep your debt payments below 36% of your gross income.

Conclusion

Securing an African bank credit card opens doors to financial convenience and opportunities. By understanding the application requirements, preparing the necessary documents, and demonstrating financial responsibility, you can confidently navigate the process and unlock a world of possibilities. Remember to compare offerings from different banks to find the card that best suits your financial goals and lifestyle.