African Bank App APK Download: A Comprehensive Guide

Navigating the world of digital banking in Africa can be challenging. The “African Bank App Apk Download” is a popular search term, indicating a growing interest in convenient, mobile banking solutions. This guide will delve into the nuances of downloading and using African banking apps, addressing common questions and concerns while providing valuable insights into the evolving landscape of African finance.

Understanding the Need for African Bank App APK Downloads

Why are so many people searching for “african bank app apk download”? The answer lies in the increasing accessibility and affordability of smartphones across the continent. This digital revolution has empowered millions, providing access to financial services previously unavailable. Banking apps offer convenience, allowing users to manage their finances on the go, from transferring money to paying bills.

Navigating the Download Process

Downloading a banking app APK can be straightforward. Most banks have official apps listed on platforms like the Google Play Store and Apple App Store. It’s crucial to download from these official sources to ensure security and avoid malicious software. Always verify the app’s authenticity by checking the developer’s information and user reviews.

The download process usually involves searching for the specific bank’s app, clicking “install,” and accepting the app’s permissions. Once installed, users can create an account or log in with existing credentials.

African Bank App Download Process

African Bank App Download Process

Security Considerations for African Bank App APK Downloads

Security is paramount when dealing with financial apps. Downloading APKs from unofficial sources poses significant risks, including malware and data breaches. Always stick to official app stores. Look for security features within the app itself, such as two-factor authentication and biometric logins.

Protecting Your Financial Information

Never share your banking details with anyone, including app developers. Legitimate banking apps will never request sensitive information via email or SMS. Be wary of phishing scams and always report suspicious activity to your bank.

African Bank App Security Features

African Bank App Security Features

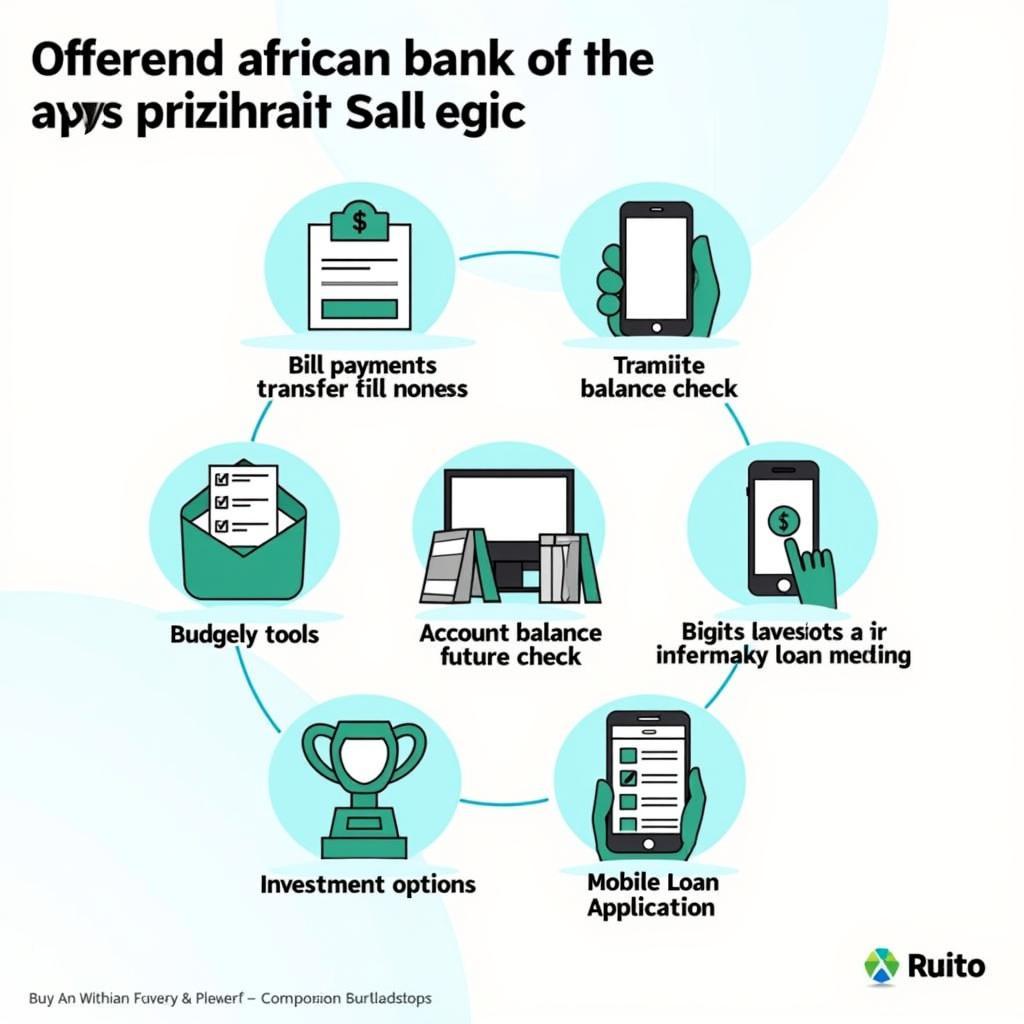

Benefits of Using African Bank Apps

African bank apps offer a multitude of benefits, including 24/7 access to your accounts, instant money transfers, bill payments, and balance checks. Many apps also provide features like transaction history, budgeting tools, and investment options.

Beyond Basic Banking

Beyond everyday transactions, some African banking apps offer innovative features like mobile loans, savings goals, and even integration with local businesses for seamless payments. These features contribute to financial inclusion and empower users to manage their finances effectively.

“The convenience and accessibility of mobile banking are transforming the financial landscape in Africa,” says Dr. Adebayo Ojo, a leading economist specializing in African financial markets. “These apps are not just about transactions; they are about empowering individuals and driving economic growth.”

African Bank App Features

African Bank App Features

Conclusion: Embracing the Future of African Banking with APK Downloads

Downloading and using an African bank app can significantly simplify your financial life. Remember to prioritize security, download from official sources, and explore the diverse features these apps offer. The “african bank app apk download” search reflects a positive trend towards digital inclusion and financial empowerment across the continent. By understanding the process and taking necessary precautions, you can harness the power of mobile banking and take control of your financial future.

FAQ

- Where can I download African bank apps safely? Always download from official app stores like Google Play Store and Apple App Store.

- Are African bank apps secure? Legitimate apps employ robust security measures, but users should also practice safe banking habits.

- What are the benefits of using a banking app? Benefits include 24/7 account access, easy transactions, and additional financial tools.

- Can I get a loan through a banking app? Many African bank apps offer mobile loan services.

- What should I do if I suspect fraudulent activity on my banking app? Immediately contact your bank and report the suspicious activity.

- Do I need internet access to use a banking app? Yes, most banking apps require an internet connection to function.

- Are there fees associated with using a banking app? This varies depending on the specific bank and the services used.

“Mobile banking isn’t just a trend; it’s a necessity in today’s interconnected world,” adds Ms. Fatima Hassan, a fintech consultant based in Nairobi. “It’s about empowering individuals with the tools they need to thrive financially.”

See also: Mobile Money in Africa, Choosing the Right Bank in Africa, Understanding African Financial Markets

When you need assistance, please contact us: Phone: +255768904061, Email: [email protected] Or visit our address: Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer service team.