African Bank Jobs: Your Guide to a Fulfilling Career in Finance

Finding fulfilling African Bank Jobs can be a rewarding experience, offering the chance to contribute to the continent’s dynamic financial sector. This guide explores various aspects of securing employment in African banks, covering everything from available roles to required skills and the application process. We’ll delve into the current job market trends and offer tips for a successful job hunt.

Exploring the Landscape of African Bank Jobs

The African banking sector is rapidly evolving, presenting diverse opportunities for professionals at all career levels. From entry-level teller positions to senior management roles, the industry offers a wide range of specializations, including retail banking, corporate banking, investment banking, and financial technology (FinTech). Understanding the current job market trends is crucial for a successful job search. The increasing demand for digital banking skills, for instance, presents an exciting avenue for tech-savvy individuals. Many institutions are actively recruiting for roles in areas such as data analytics, cybersecurity, and mobile banking.

Looking for opportunities within established institutions like the African Export Import Bank or exploring the thriving financial hub of Abidjan offers a strategic approach. These locations often boast a higher concentration of financial institutions and therefore a wider array of job opportunities.

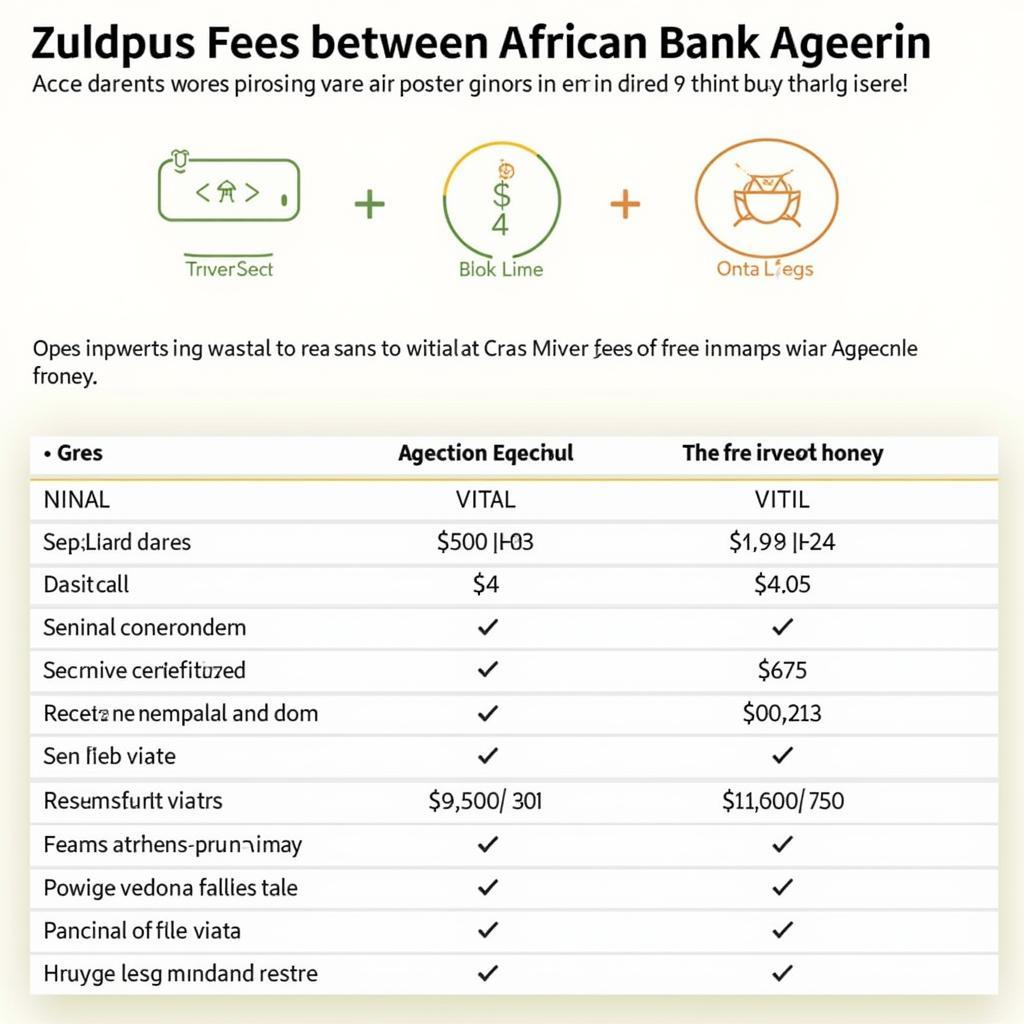

african export import bank directors

The demand for specialized skills is also influencing the recruitment landscape. Banks are seeking professionals with expertise in risk management, regulatory compliance, and sustainable finance. Those with a strong understanding of the African economic landscape and local market dynamics are highly sought after.

Types of African Bank Jobs and Required Skills

Whether you’re a recent graduate or an experienced professional, there’s a niche for you within the African banking sector. Entry-level roles, such as tellers and customer service representatives, require strong communication and interpersonal skills. Mid-level positions, like loan officers and financial analysts, demand analytical prowess and a deep understanding of financial principles. For senior management roles, leadership experience, strategic thinking, and a proven track record are essential.

A strong academic background in finance, accounting, or economics is often a prerequisite for many African bank jobs. However, practical experience through internships or volunteer work can significantly enhance your candidacy. Additionally, professional certifications, such as those offered by the Chartered Institute of Bankers, can demonstrate your commitment to the field and provide a competitive edge.

african development bank abidjan

The evolving landscape necessitates adapting to the changing demands of the financial sector. Proficiency in relevant software and technology, alongside a commitment to continuous learning, are increasingly valuable assets for individuals seeking employment in African banks.

Navigating the Application Process for African Bank Jobs

The application process typically begins with submitting a comprehensive resume and cover letter that highlight your skills and experience relevant to the specific position. Tailoring your application materials to each job description is crucial for showcasing your suitability. Researching the specific bank and its values allows you to demonstrate your understanding of their mission and how your skills align with their objectives.

Networking within the industry can be invaluable. Attending industry events, connecting with professionals on LinkedIn, and leveraging your existing network can provide insights into job openings and offer opportunities to learn from experienced individuals. Preparing for interviews is equally important. Practice answering common interview questions, research the interviewer, and be prepared to discuss your career goals and how they align with the bank’s vision.

Demonstrating a genuine interest in the African financial landscape and a passion for contributing to its growth can make a lasting impression on potential employers. Highlight any experience or knowledge you have of the local market and the specific challenges and opportunities within the African banking sector.

Conclusion: Embarking on Your African Banking Career

Securing African bank jobs requires a combination of the right skills, a strategic approach to job hunting, and a deep understanding of the African financial landscape. By staying informed about industry trends, honing your skills, and tailoring your application materials, you can increase your chances of landing your dream job and contributing to the growth of the African banking sector. Remember, perseverance and a positive attitude are key to a successful job search. So, start exploring the diverse opportunities available and embark on your fulfilling career in African banking today!

FAQ

- What are the most in-demand skills for African bank jobs? Digital banking skills, risk management, regulatory compliance, and sustainable finance expertise are highly sought after.

- How can I improve my chances of getting hired? Tailor your application materials, network within the industry, and prepare thoroughly for interviews.

- Are internships important for securing an entry-level position? Yes, internships provide valuable practical experience and can significantly enhance your candidacy.

- What qualifications are typically required for banking roles? A degree in finance, accounting, or economics is often preferred, along with relevant professional certifications.

- Where can I find job openings in African banks? Bank websites, online job boards, and professional networking platforms are good resources.

- How important is local market knowledge? Understanding the African economic landscape and local market dynamics is highly valued by employers.

- What are the career progression opportunities in African banking? The industry offers diverse career paths, from entry-level positions to senior management roles.

african development bank jobs in sudan

Here are some other questions you might have:

- What are the salary expectations for different banking roles in Africa?

- What are the challenges and opportunities within the African banking sector?

- How can I prepare for a career in FinTech within Africa?

Explore these related articles on our website:

- Careers in Microfinance in Africa

- The Impact of Mobile Banking on the African Economy

When you need support, please contact us by Phone: +255768904061, Email: [email protected] or visit our address: Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer service team.