African Banking Corporation Kenya: A Comprehensive Overview

African Banking Corporation Kenya is a vital player in Kenya’s financial landscape, contributing significantly to the country’s economic growth. This article explores the bank’s role, services, and impact within the Kenyan and broader African context. We delve into its history, analyze its current position, and consider its future prospects in the dynamic African financial sector.

Understanding the evolution, challenges, and opportunities facing African Banking Corporation Kenya is essential for anyone interested in the African banking sector. This detailed analysis provides valuable insights into the institution and its contributions to Kenya’s financial development.

Exploring the African banking sector often leads to career opportunities. For those interested, you can find more information on African Development Bank careers.

Kenya’s financial landscape has been significantly shaped by institutions like African Banking Corporation Kenya. Their presence has fostered economic growth and provided crucial financial services to businesses and individuals.

African Banking Corporation Kenya's Branch Network

African Banking Corporation Kenya's Branch Network

History and Evolution of African Banking Corporation Kenya

African Banking Corporation Kenya has a rich history, intertwined with the development of Kenya’s financial system. From its early days as a small financial institution, the bank has grown to become a significant player in the Kenyan market. Its journey reflects the challenges and triumphs of the nation’s economic progress. Understanding this history is crucial to appreciating the bank’s current role and future potential. The bank’s evolution has been marked by periods of rapid growth, strategic acquisitions, and adaptation to changing regulatory environments.

The growth of the bank demonstrates its resilience and adaptability. Its success is not merely a reflection of its own strategic decisions but also a testament to the growing strength of the Kenyan economy.

Key Milestones in the Bank’s Development

- Early Years: The bank’s founding and its initial focus on serving local communities.

- Expansion Phase: The bank’s strategic expansion across Kenya through branch openings and mergers.

- Modernization: The adoption of new technologies and digital banking solutions.

- Current Position: The bank’s current market share, services offered, and strategic focus.

African Banking Corporation Nairobi is a key hub for the bank’s operations, reflecting the city’s importance as a financial center.

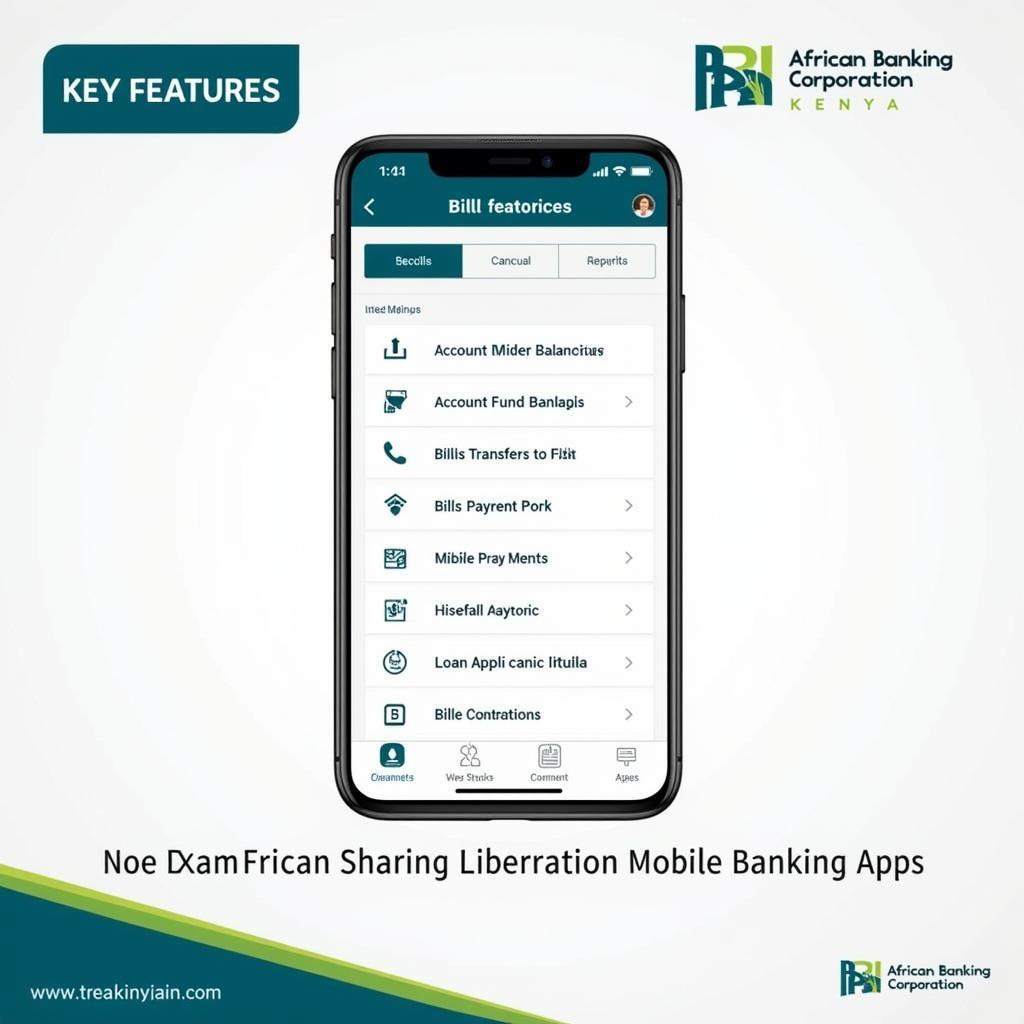

African Banking Corporation Kenya Mobile Banking App

African Banking Corporation Kenya Mobile Banking App

Services Offered by African Banking Corporation Kenya

African Banking Corporation Kenya caters to a wide range of customers, from individuals to large corporations. Its diverse portfolio of services reflects its commitment to meeting the evolving needs of the Kenyan market. These services include:

- Retail Banking: Personal accounts, loans, mortgages, and credit cards.

- Corporate Banking: Business accounts, lending solutions, trade finance, and treasury management.

- Investment Banking: Financial advisory, underwriting, and mergers and acquisitions support.

- Digital Banking: Online and mobile banking platforms, providing convenient access to services.

The bank’s comprehensive range of services reflects its commitment to serving all segments of the Kenyan market.

Focusing on Customer Needs

The bank’s success stems from its customer-centric approach. By consistently striving to understand and meet customer needs, African Banking Corporation Kenya has built a strong reputation for reliability and service excellence. This focus is evident in the bank’s ongoing investments in technology and customer service training.

“African Banking Corporation Kenya has always prioritized customer satisfaction. We believe that by providing exceptional service and tailored solutions, we can empower our customers to achieve their financial goals.” – Dr. Adebayo Olajide, Financial Analyst.

African Banking Corporation Kenya’s Impact on the Kenyan Economy

African Banking Corporation Kenya plays a vital role in supporting Kenya’s economic growth. By providing access to finance for businesses and individuals, it fosters entrepreneurship, job creation, and investment. Its contribution extends beyond purely financial services, encompassing social initiatives and community development programs.

“The bank’s commitment to financial inclusion has been instrumental in empowering marginalized communities and driving economic growth at the grassroots level.” – Ms. Amina Hassan, Economist.

African Banking Corporation Kenya Community Development Project

African Banking Corporation Kenya Community Development Project

Conclusion: The Future of African Banking Corporation Kenya

African Banking Corporation Kenya is well-positioned for continued growth and success in the evolving African financial landscape. Its commitment to innovation, customer service, and social responsibility will be crucial in navigating the challenges and opportunities that lie ahead. African Banking Corporation Kenya remains a key player in Kenya’s economic development, offering essential financial services and contributing to the nation’s prosperity.

FAQ

- What types of accounts does African Banking Corporation Kenya offer?

- How can I access online banking services?

- Does the bank offer international money transfer services?

- What are the bank’s lending rates for personal loans?

- How can I contact customer support?

- What are the bank’s branch locations?

- Does the bank have any community development programs?

Other Questions and Related Articles

- What are the latest trends in the Kenyan banking sector?

- How does African Banking Corporation Kenya compare to other banks in the region?

- What are the future prospects for the African financial market?

Contact Us

When you need assistance, please contact us by Phone: +255768904061, Email: [email protected] or visit our address: Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer service team.