African Bank to Capitec Transfer Time: A Comprehensive Guide

Understanding the transfer time between African Bank and Capitec is crucial for managing your finances effectively. This guide will delve into the various factors influencing these transfer times, providing you with the knowledge you need to make informed decisions.

Decoding African Bank to Capitec Transfer Times

Several factors can influence how long it takes for money to move between African Bank and Capitec. These include the type of transfer, the time of day, and any potential processing delays. Let’s break down these elements for a clearer understanding.

Different Transfer Methods and Their Timeframes

The method you choose to transfer money plays a significant role in determining the speed of the transaction. Electronic Funds Transfers (EFTs) are a common choice, typically taking 1-2 business days to clear. However, some newer, faster payment options might be available, offering near-instantaneous transfers. It’s important to compare the available methods and choose the one that best suits your needs.

The Impact of Business Days and Weekends on Transfer Times

Keep in mind that weekends and public holidays can impact transfer times. If you initiate a transfer on a Friday afternoon, it likely won’t be processed until the following Monday. This is a standard practice within the banking sector, so always factor this into your calculations.

Navigating Potential Delays and Issues

While most transfers go through smoothly, occasional delays can occur. These can be due to technical issues, high transaction volumes, or incorrect beneficiary details. Always double-check the recipient’s account information before initiating a transfer to avoid unnecessary delays. If you encounter any issues, contacting your bank’s customer support is the best course of action.

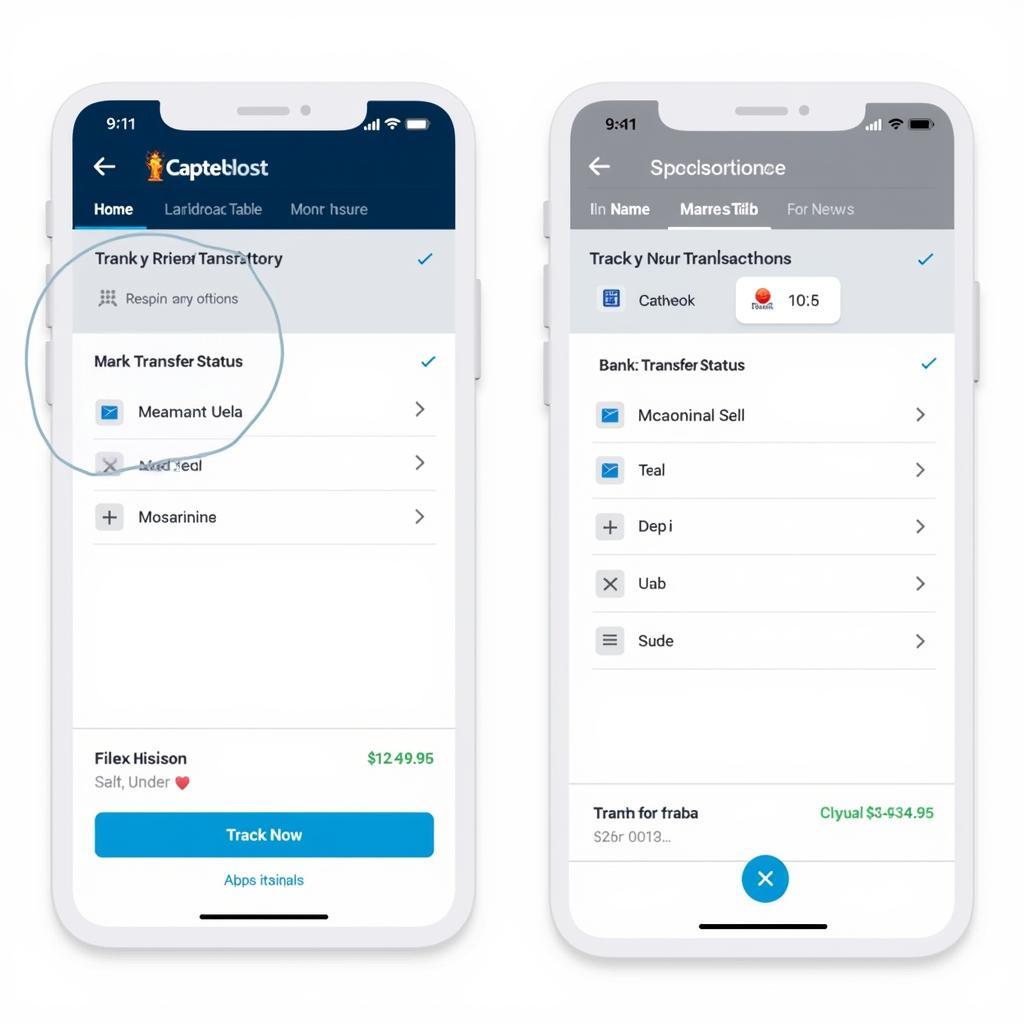

How to Check Your Transfer Status

Both African Bank and Capitec offer ways to track your transfer status online or via their mobile apps. This allows you to monitor the progress of your transfer and identify any potential issues promptly. Familiarize yourself with these tracking tools to stay informed about your transactions.

Understanding Transfer Fees and Charges

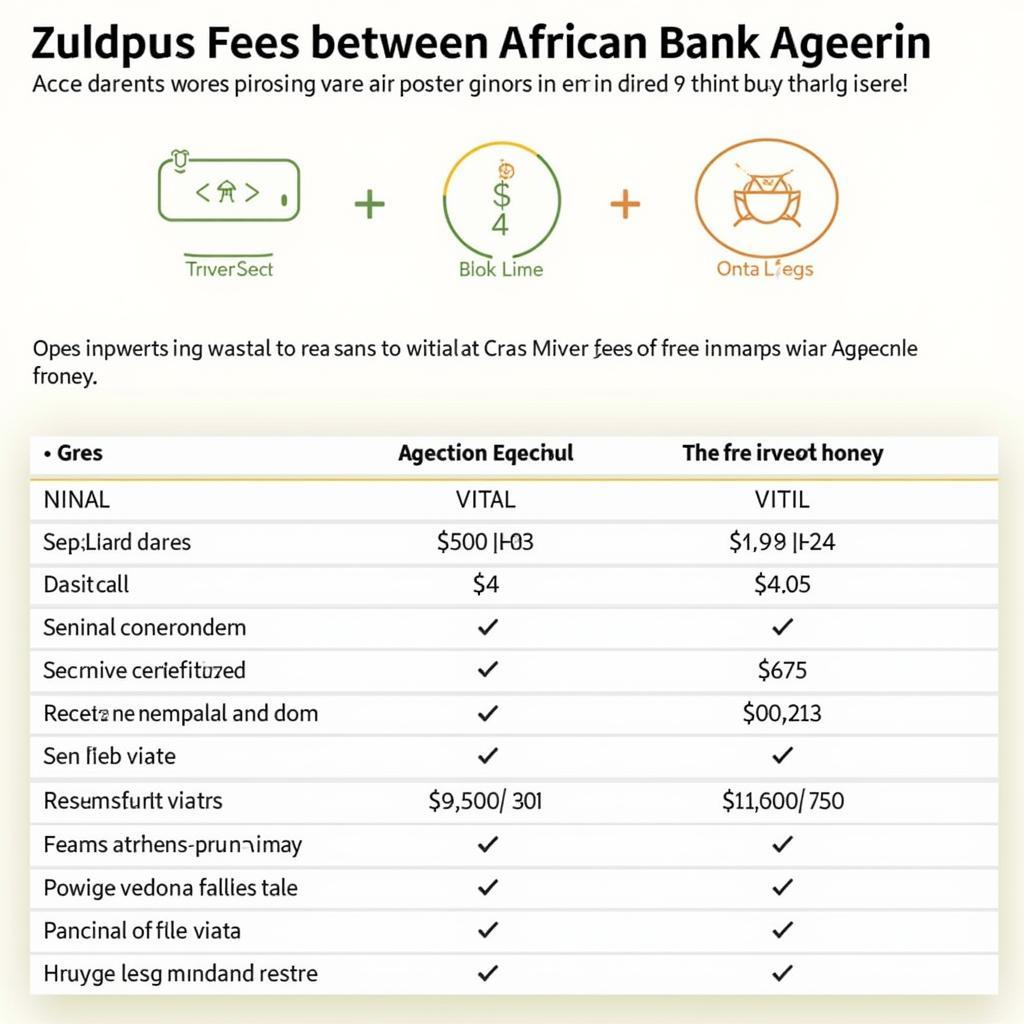

It’s essential to be aware of any fees associated with transferring money between these two banks. While some transfers might be free, others may incur charges depending on the chosen method and the amount being transferred. Always check the fee schedule before initiating a transfer.

African Bank and Capitec Transfer Fees Breakdown

African Bank and Capitec Transfer Fees Breakdown

Tips for Faster and Smoother Transfers

Planning ahead and double-checking all details are crucial for a seamless transfer experience. Opting for faster payment methods when available and initiating transfers during business hours can significantly reduce processing time.

What to Do if Your Transfer is Delayed

If your transfer is taking longer than expected, don’t panic. Contact your bank’s customer support, providing them with the transaction details. They can investigate the issue and provide updates on the status of your transfer.

“Accurate beneficiary details are paramount for timely transfers. Always verify the account number and branch code before hitting send,” advises Siyabonga Khumalo, a seasoned financial advisor based in Johannesburg.

African Bank and Capitec Mobile Banking Apps for Transfer Tracking

African Bank and Capitec Mobile Banking Apps for Transfer Tracking

Conclusion: Mastering African Bank to Capitec Transfer Times

Understanding the nuances of African Bank To Capitec Transfer Time is key to managing your finances efficiently. By choosing the right transfer method, considering business hours, and verifying all details, you can ensure your transfers are processed as quickly and smoothly as possible.

FAQ

- What is the typical African Bank to Capitec transfer time?

- Are there any fees associated with transfers between these banks?

- How can I track the status of my transfer?

- What should I do if my transfer is delayed?

- What are the different transfer methods available?

- How do weekends and holidays affect transfer times?

- Can I transfer money instantly between African Bank and Capitec?

“Using mobile banking apps can streamline the transfer process and provide real-time updates on your transactions,” adds Thandiwe Ndlovu, a banking expert from Cape Town.

For further information, explore our articles on “Understanding Electronic Funds Transfers” and “Choosing the Right Banking App for Your Needs.”

Need assistance? Contact us 24/7: Phone: +255768904061, Email: [email protected] or visit us at Mbarali DC Mawindi, Kangaga, Tanzania. Our dedicated customer service team is here to help.