Understanding African Eagle Insurance

African Eagle Insurance is an essential topic for anyone interested in navigating the complexities of financial security within the diverse landscape of the African continent. This article delves into the significance of insurance, exploring various aspects, challenges, and opportunities within the African insurance market, focusing on how it can empower individuals and businesses across the continent.

The Importance of Insurance in Africa

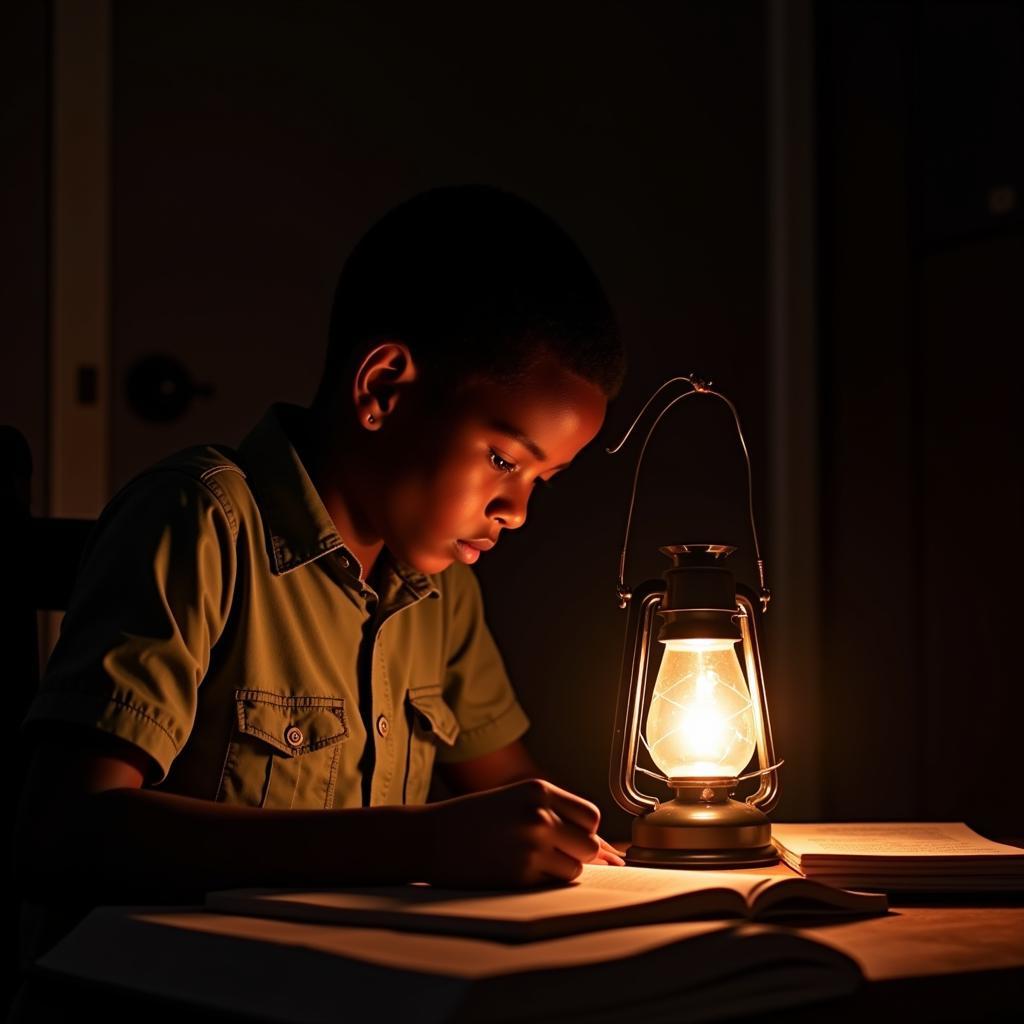

Insurance plays a crucial role in mitigating risks and fostering economic stability, particularly in a continent as diverse and dynamic as Africa. From protecting small businesses against unforeseen events to providing families with financial security in times of crisis, insurance offers a safety net that can be transformative. The growth of the African insurance sector is vital for sustainable economic development, as it encourages investment, reduces financial vulnerability, and empowers communities to thrive. The penetration of insurance in Africa remains relatively low compared to other regions, highlighting both the challenges and opportunities within this evolving market. Access to suitable insurance products can be a game-changer for individuals and businesses, empowering them to manage risks and build a more secure future.

10 facts about south african culture

Navigating the African Insurance Landscape: Key Challenges and Opportunities

The African insurance market presents unique challenges and opportunities. Factors such as limited financial literacy, inadequate regulatory frameworks in some regions, and the prevalence of informal economies can hinder the growth of the insurance sector. However, the increasing adoption of mobile technology, a burgeoning middle class, and growing awareness of the importance of risk management are creating exciting opportunities for innovation and expansion within African Eagle Insurance and the broader insurance landscape. Innovative insurance products tailored to the specific needs of African communities, such as micro-insurance and mobile-based insurance solutions, are gaining traction and hold significant potential for driving financial inclusion and resilience.

What are the main types of insurance available in Africa?

The main types of insurance available in Africa mirror those found globally, including life insurance, health insurance, property insurance, and motor vehicle insurance. However, specialized products like agricultural insurance and micro-insurance are increasingly relevant in addressing the unique risks faced by communities across the continent.

African Eagle Insurance: A Focus on Growth and Inclusion

With the diverse challenges and opportunities in mind, African Eagle Insurance companies are working to enhance financial security and resilience across the continent. They are developing tailored products and services that cater to the specific needs of African communities, promoting financial literacy, and leveraging technology to enhance access and affordability. These initiatives are crucial for driving financial inclusion and empowering individuals and businesses to thrive in an increasingly complex and interconnected world.

How is technology impacting the African insurance sector?

Technology is transforming the African insurance sector, particularly through mobile platforms. Mobile money and mobile-based insurance solutions are increasing access to insurance products, especially for those in underserved communities. This digital revolution is streamlining processes, reducing costs, and making insurance more accessible and convenient for millions of Africans.

Impact of Mobile Technology on African Insurance

Impact of Mobile Technology on African Insurance

Building Trust and Transparency in the African Insurance Sector

Building trust and transparency are essential for the long-term success of the African insurance industry. Clear communication, ethical practices, and robust regulatory frameworks are crucial for fostering confidence among consumers and encouraging wider adoption of insurance products.

“Trust is the foundation of the insurance industry,” says Dr. Abena Osei, a renowned financial expert specializing in African markets. “Transparency and ethical practices are essential for building that trust and ensuring the sustainable growth of the insurance sector across the continent.”

What are the future prospects for African Eagle Insurance?

The future of African Eagle Insurance looks promising, with significant growth potential driven by technological advancements, increasing awareness of risk management, and a growing middle class. Innovative insurance solutions tailored to the specific needs of African communities will play a key role in shaping the future of the industry.

Conclusion

African Eagle Insurance offers crucial financial protection and promotes economic stability across the continent. Addressing the challenges and capitalizing on the opportunities within the African insurance market is essential for driving sustainable economic growth and empowering individuals and businesses. By embracing innovation, promoting financial literacy, and building trust, African Eagle Insurance can play a transformative role in shaping a more secure and prosperous future for Africa.

FAQ

- What is micro-insurance?

- How can I access insurance in a remote area?

- What are the benefits of having life insurance?

- How can I compare different insurance providers?

- What are the key considerations when choosing an insurance policy?

- How is climate change impacting insurance in Africa?

- What role does the government play in regulating the insurance sector?

Need More Information?

For more insights, explore other related articles on our website:

- Insurance in Emerging Markets

- The Role of Technology in African Finance

- Understanding Risk Management in Africa

Need assistance? Contact us: Phone: +255768904061, Email: [email protected] or visit our office at Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer service team.