African Countries Debt List 2018: A Deep Dive into Sovereign Debt

African Countries Debt List 2018 reveals a complex picture of economic realities across the continent. Understanding the debt landscape requires looking beyond just numbers and delving into the historical, political, and economic factors that contribute to these figures. This article explores the nuances of African debt in 2018, examining its various dimensions and implications.

Unpacking the African Countries Debt List 2018

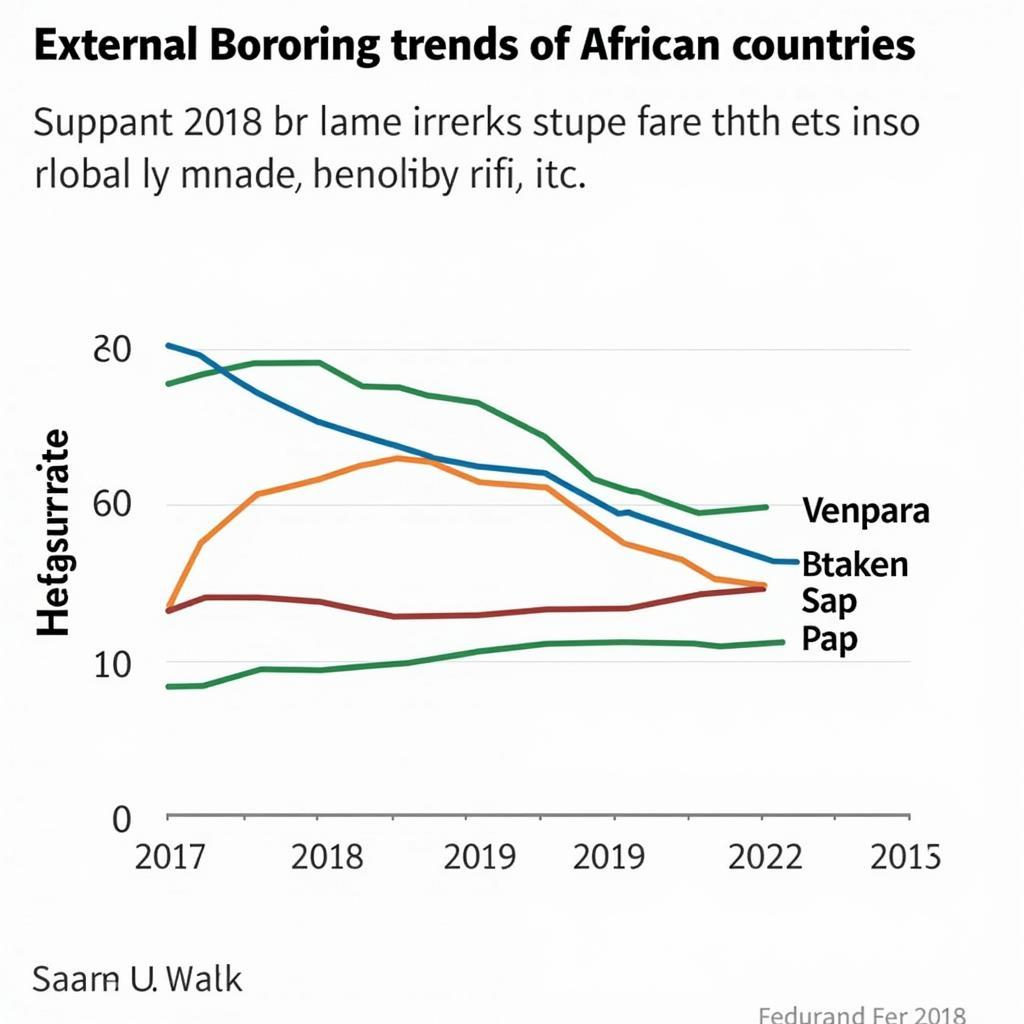

The year 2018 marked a critical point in the ongoing narrative of African debt. While some countries experienced economic growth and managed their debt effectively, others faced significant challenges. Accessing reliable data on the specific debt figures for each African nation in 2018 can be difficult, as data collection and reporting practices vary. However, focusing on the broader trends and underlying issues provides valuable insights. One key factor contributing to debt accumulation in some African countries is the reliance on external borrowing, often from international financial institutions or developed nations.

African External Borrowing in 2018

African External Borrowing in 2018

These loans, while sometimes necessary for infrastructure development or social programs, can become burdensome if not managed effectively. Additionally, fluctuations in global commodity prices, particularly for resource-rich African nations, can significantly impact their ability to repay debts.

The Impact of Debt on African Economies

High levels of debt can stifle economic growth and limit a nation’s ability to invest in critical areas like education, healthcare, and infrastructure. This can create a vicious cycle of debt, where countries struggle to generate enough revenue to service their existing debts, leading to further borrowing. Furthermore, debt can exacerbate existing social and political inequalities, potentially leading to instability.

The Impact of Debt on African Economies

The Impact of Debt on African Economies

For instance, when governments are forced to cut spending on social programs due to debt servicing obligations, it disproportionately affects vulnerable populations. However, it’s important to remember that debt isn’t inherently negative. Responsible borrowing and strategic investment can lead to significant economic development and progress.

“Debt can be a tool for growth, but it must be managed responsibly,” says Dr. Adebayo Ojo, a renowned economist specializing in African development. “Transparency, accountability, and sustainable investment practices are crucial for ensuring that borrowed funds are used effectively and contribute to long-term economic prosperity.”

Moving Beyond the Numbers: A Holistic Perspective

Analyzing the African countries debt list 2018 requires looking beyond just the raw figures. Understanding the historical context, political dynamics, and specific economic circumstances of each country is essential for a nuanced perspective. For example, some African nations are heavily reliant on specific commodities, making them vulnerable to price fluctuations in the global market. This vulnerability can directly impact their ability to manage debt. Furthermore, internal factors such as corruption, weak governance, and conflict can exacerbate debt challenges.

A Holistic Perspective on African Debt

A Holistic Perspective on African Debt

“It’s essential to recognize the diversity of experiences across the African continent,” explains Dr. Fatima Hassan, a leading expert on African economic policy. “A one-size-fits-all approach to debt management is ineffective. Tailored solutions that address the unique challenges and opportunities of each nation are crucial for achieving sustainable economic progress.” It is also crucial to consider the role of international financial institutions and developed nations in shaping the debt landscape of African countries.

Conclusion: Addressing African Debt in a Changing World

The African countries debt list 2018 serves as a reminder of the complex economic realities faced by many nations across the continent. While the challenges are significant, there are also opportunities for growth and development. By adopting sustainable economic policies, promoting good governance, and fostering strategic partnerships, African countries can navigate the complexities of debt and strive for a more prosperous future. Understanding the specifics of the debt list requires delving deeper into individual country data and analyzing trends over time. For a comprehensive understanding of the economic landscape of African countries, it’s also worthwhile exploring resources like African countries by GDP per capita and considering perspectives on whether the African continent broke.

FAQ

- What were the primary sources of debt for African countries in 2018?

- How did commodity price fluctuations affect debt levels in 2018?

- What strategies were employed by African countries to manage their debt in 2018?

- What role did international financial institutions play in addressing African debt in 2018?

- What are the long-term implications of the 2018 debt levels for African economies?

- How does the 2018 debt list compare to previous years?

- What lessons can be learned from the 2018 debt situation?

Other relevant articles you may find interesting include insights into the GDP per capita of various African nations and discussions about the financial state of the continent. You can also find further information by exploring our articles african countries by gdp per capita and african continent broke.

When you need support, please contact Phone Number: +255768904061, Email: [email protected] Or visit: Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer support team.