Understanding African Banking Corporation Holdings

African Banking Corporation Holdings (ABCH) is a complex and evolving landscape. This article delves into the nuances of ABCH, exploring its history, current state, and future potential, offering valuable insights for investors, researchers, and anyone interested in the African financial sector.

A Deep Dive into African Banking Corporation Holdings

Overview of African Banking Corporation Holdings

Overview of African Banking Corporation Holdings

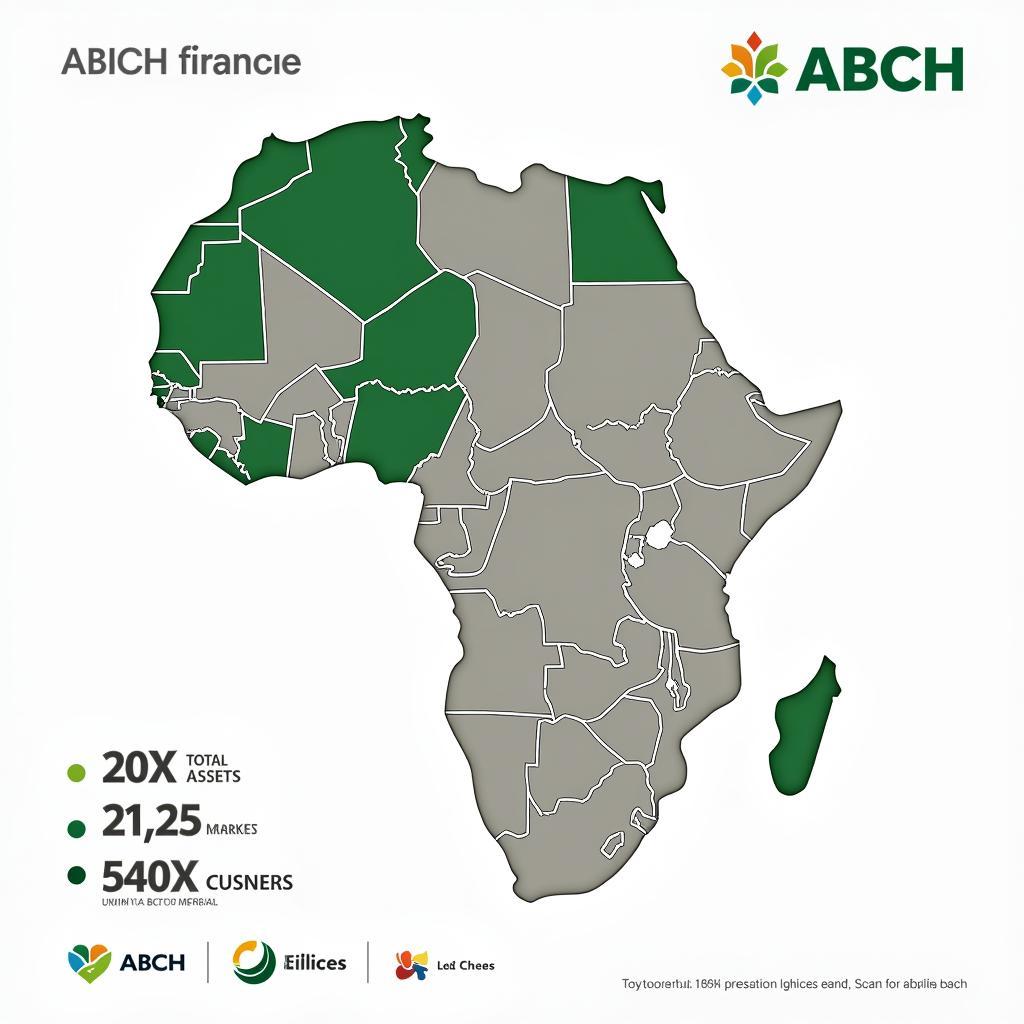

The term “African Banking Corporation Holdings” itself doesn’t refer to a single, specific entity. It’s more of a conceptual umbrella encompassing various banking groups and holding companies operating across the African continent. Understanding this requires looking at the diverse landscape of African banking. Several prominent banks across Africa operate under holding company structures, often with subsidiaries in multiple countries. These holdings play a crucial role in driving economic growth and financial inclusion across the continent. They are often involved in retail banking, corporate banking, investment banking, and increasingly, fintech solutions.

The Role of ABCH in Africa’s Economic Development

african bank ltd are crucial for driving economic growth and financial inclusion across the continent. They often provide essential financial services to underserved populations and contribute to the development of local economies.

Impact of African Banking Corporation Holdings on Economic Growth

Impact of African Banking Corporation Holdings on Economic Growth

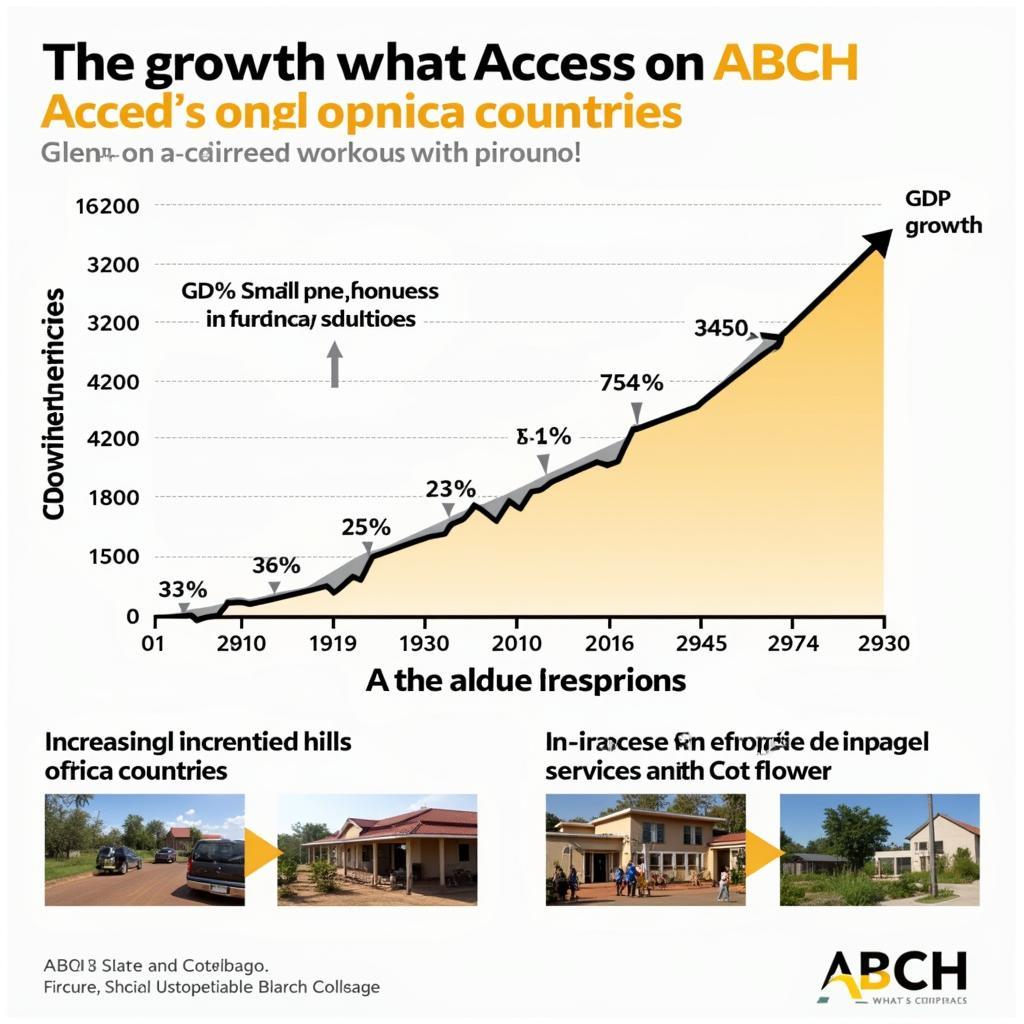

These holdings have played a key role in modernizing financial systems, introducing new technologies, and facilitating cross-border transactions. Their presence has also attracted foreign investment, fostering competition and innovation within the African financial sector. By providing capital and financial expertise, they empower local businesses and entrepreneurs, driving job creation and economic expansion.

Challenges and Opportunities for African Banking Corporation Holdings

The African banking sector faces unique challenges, including regulatory complexities, infrastructure limitations, and varying levels of financial literacy across different regions. However, these challenges also present significant opportunities for growth and innovation. The rapid adoption of mobile technology has opened up new avenues for financial inclusion, allowing banks to reach previously unbanked populations. Moreover, the burgeoning middle class and increasing intra-African trade are creating a growing demand for sophisticated financial products and services.

The Future of African Banking Corporation Holdings

african bank limited news and other similar holdings are continuously evolving to adapt to the changing financial landscape.

The increasing integration of technology, the rise of fintech, and the growing focus on sustainable finance are shaping the future of ABCH. These institutions are investing heavily in digital platforms, exploring new business models, and partnering with fintech companies to enhance their offerings and reach a wider customer base.

“The future of African banking lies in embracing innovation and leveraging technology to provide inclusive and sustainable financial solutions,” says Dr. Adebayo Ogunlesi, a prominent economist specializing in African financial markets.

“ABCH needs to prioritize financial literacy programs to empower individuals and businesses to make informed financial decisions,” adds Ms. Fatima Hassan, a leading financial analyst focusing on African banking regulations.

Conclusion

African Banking Corporation Holdings represents a dynamic and influential force in the African financial landscape. While the term encompasses a broad range of institutions, its underlying significance lies in the crucial role these holdings play in driving economic development and financial inclusion across the continent. As the African financial sector continues to evolve, ABCH is poised to play an even greater role in shaping the future of African economies.

FAQs

- What does ABCH stand for? ABCH is a general term referring to African Banking Corporation Holdings.

- What is the role of ABCH in Africa? ABCH drives economic growth and financial inclusion.

- What are the challenges faced by ABCH? Challenges include regulatory complexities and infrastructure limitations.

- What are the opportunities for ABCH? Opportunities include leveraging mobile technology and serving a growing middle class.

- What is the future of ABCH? The future involves embracing technology, fintech, and sustainable finance.

When needing assistance, please contact Phone: +255768904061, Email: [email protected], or visit Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer service team.