African 1 Dollar Is Equal to How Much Rupee?

Understanding currency exchange rates is essential for anyone traveling to or doing business with other countries. If you’re planning a trip to Africa or engaging in financial transactions with African nations, you might be wondering, “African 1 dollar is equal to how much rupee?” This comprehensive guide delves into the intricacies of currency conversions, specifically focusing on the relationship between the US dollar and various African currencies pegged to the rupee.

Demystifying Currency Conversions: A Look at Exchange Rates

Currency exchange rates fluctuate constantly based on various economic factors, including inflation, interest rates, government policies, and market speculation. Therefore, there is no single, fixed answer to the question of how much an “African dollar” is worth in rupees. In reality, “African dollar” is not a recognized currency. Africa is a vast continent with 54 independent countries, each having its unique currency.

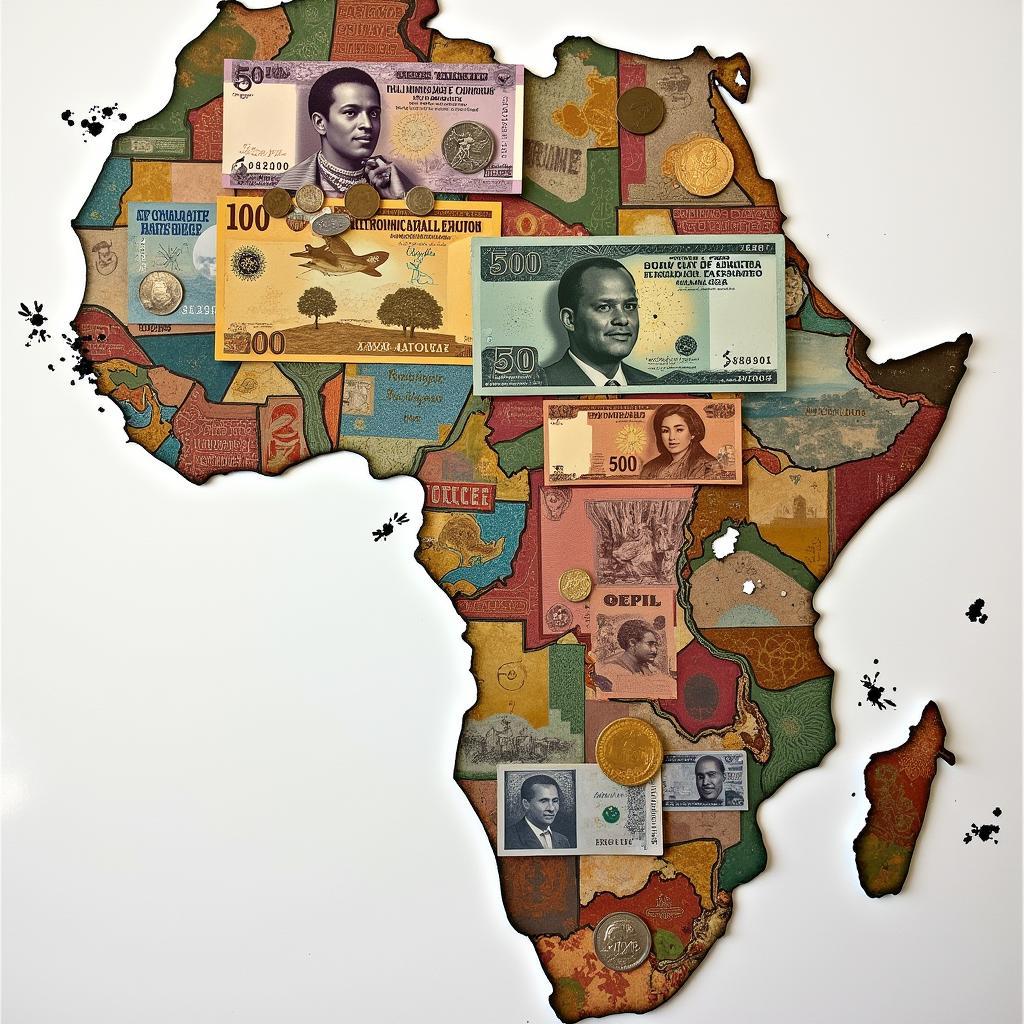

Various African currencies

Various African currencies

Key African Currencies and Their Relationship to the Rupee

While it’s impossible to provide an exact conversion rate for “African 1 dollar,” we can explore the values of some prominent African currencies in relation to the Indian rupee (INR):

-

South African Rand (ZAR): The South African Rand is a widely traded currency. As of today, 1 US dollar roughly equals 18.50 South African Rands. The current exchange rate for 1 South African Rand to Indian Rupees is approximately 4.70 INR.

-

Egyptian Pound (EGP): The Egyptian Pound is another major currency in Africa. Currently, 1 US dollar is approximately equivalent to 30.90 Egyptian Pounds. The exchange rate for 1 Egyptian Pound to Indian Rupees stands at around 2.80 INR.

-

Nigerian Naira (NGN): The Nigerian Naira is the official currency of the most populous country in Africa. At present, 1 US dollar is equal to about 750 Nigerian Naira. The conversion rate for 1 Nigerian Naira to Indian Rupees is about 0.13 INR.

-

Kenyan Shilling (KES): Widely used in East Africa, the Kenyan Shilling currently trades at roughly 145 KES to 1 US dollar. One Kenyan Shilling is approximately equal to 0.68 INR.

Person using a currency exchange app

Person using a currency exchange app

Navigating Currency Exchange: Tips for Travelers

For travelers venturing into the diverse landscapes of Africa, understanding how to navigate currency exchange is crucial. Here are some valuable tips:

-

Research Before You Go: Before embarking on your African adventure, familiarize yourself with the local currency of your destination country. Check the current exchange rates online using reliable sources like Google Finance or XE.com.

-

Avoid Airport Exchanges: While airport currency exchange kiosks offer convenience, they often charge higher fees and offer less favorable rates. Consider exchanging a small amount at the airport for immediate expenses and then explore better options in the city.

-

Banks and ATMs: Banks typically provide competitive exchange rates. Using your debit card at ATMs is often the most cost-effective way to withdraw local currency, but be mindful of potential foreign transaction fees charged by your bank.

-

Credit Cards: Major credit cards are widely accepted in urban areas and tourist destinations across Africa. However, it’s wise to inform your bank about your travel plans to avoid any issues with card usage.

-

Negotiate and Compare: When exchanging currency at banks or exchange bureaus, don’t hesitate to negotiate for a better rate, especially for larger transactions. Compare rates from different providers to secure the most favorable deal.

Conclusion: Staying Informed for Seamless Transactions

While the question “African 1 dollar is equal to how much rupee?” may not have a straightforward answer, understanding the dynamics of currency conversions is crucial for anyone engaging with African economies. By staying informed about exchange rates, researching local currencies, and following practical tips, you can ensure smooth and cost-effective financial transactions throughout your African journey.