Navigating African Bank Complaints: A Comprehensive Guide

Dealing with African Bank Complaints can be a frustrating experience. This guide provides valuable information and resources to help you navigate the process effectively and efficiently, ensuring your concerns are addressed and resolved.

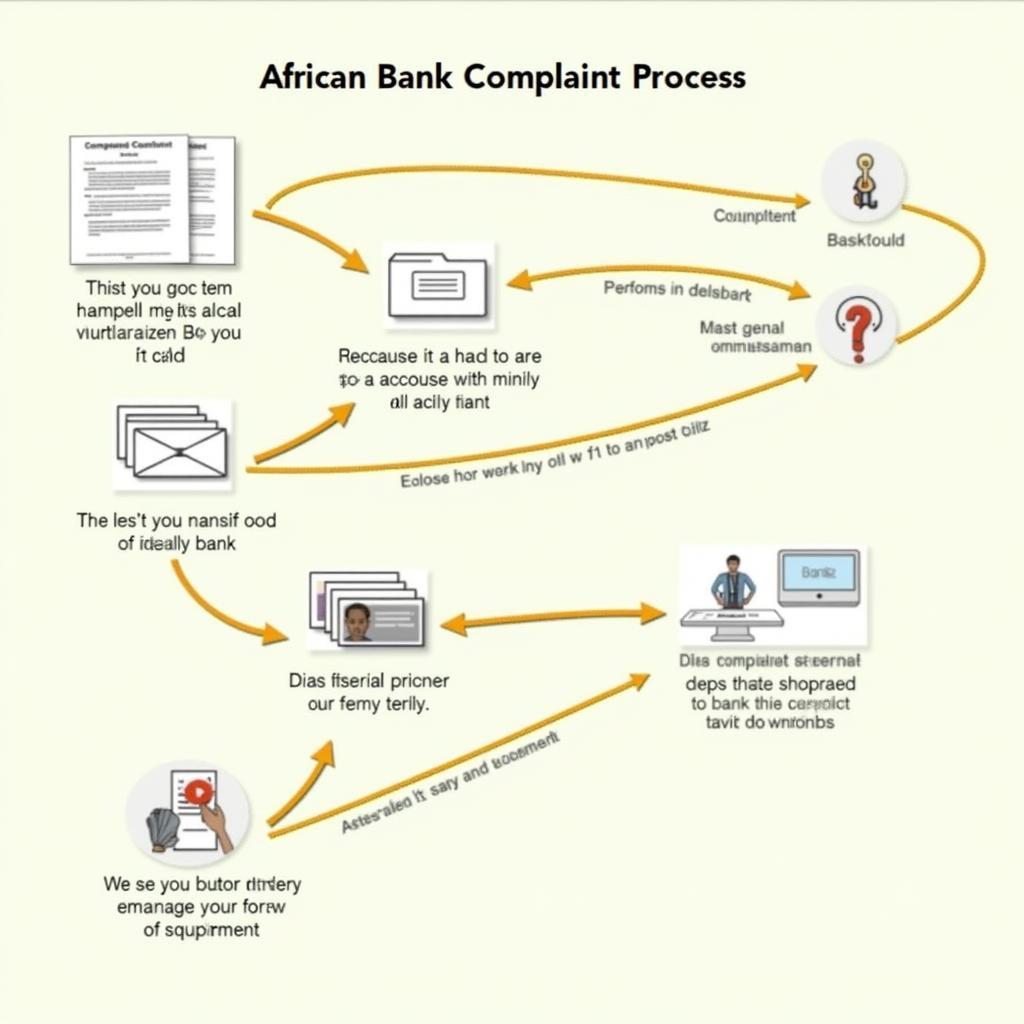

Understanding the African Bank Complaints Process

Before lodging a complaint, it’s essential to understand the procedures involved. Each African bank has its own internal complaints process, typically outlined on their website or in their terms and conditions. Familiarizing yourself with these procedures is the first step towards a successful resolution. These procedures generally involve submitting a formal complaint, providing supporting documentation, and awaiting a response within a specified timeframe. Remember to keep records of all communication and documentation related to your complaint. This meticulous record-keeping will prove invaluable throughout the process. Knowing your rights as a customer is crucial when dealing with African bank complaints.

African Bank Complaint Process Flowchart

African Bank Complaint Process Flowchart

Many complaints can be resolved at the branch level through direct communication with bank staff. However, if your initial attempt is unsuccessful, escalating the complaint to higher authorities within the bank is the next logical step. Understanding the hierarchy of the complaints process ensures you direct your complaint to the appropriate level for timely and effective resolution.

african bank head office contact details

Common African Bank Complaints and Solutions

Several recurring themes emerge in African bank complaints, ranging from unauthorized transactions and incorrect fees to poor customer service and issues with online banking platforms. Identifying the specific nature of your complaint is crucial for tailoring your approach and finding the most appropriate solution. For example, if you’re experiencing difficulties with online banking, contacting the bank’s technical support team might be the most effective course of action. Alternatively, for complaints regarding account discrepancies, reaching out to the bank’s customer service department would be more appropriate.

Unauthorized Transactions and Fraudulent Activities

Unauthorized transactions are a significant concern. If you notice any suspicious activity on your account, immediately notify the bank and follow their procedures for reporting fraudulent transactions. This prompt action can help minimize potential losses and safeguard your financial security.

Incorrect Fees and Charges

Banks sometimes make mistakes. If you believe you’ve been incorrectly charged, gather supporting documentation, such as account statements and transaction records, to substantiate your claim. Presenting clear and concise evidence strengthens your case and increases the likelihood of a favorable outcome.

Poor Customer Service and Communication

Experiencing unhelpful or unresponsive customer service can be frustrating. When addressing such issues, remain calm and clearly articulate your concerns. Documenting each interaction, including dates, times, and names of individuals you spoke with, can help track the progress of your complaint.

“Effective communication is key to resolving any banking dispute,” says Dr. Adebayo Ojo, a financial expert specializing in African banking systems. “Clearly stating your concerns and providing relevant documentation significantly increases the chances of a swift and satisfactory resolution.”

Navigating the African Bank Ombudsman

If your complaint remains unresolved after exhausting the bank’s internal processes, seeking assistance from the African Bank Ombudsman is an option. The Ombudsman acts as an independent mediator between the bank and the customer, facilitating a fair and impartial resolution. Understanding the Ombudsman’s role and the process for submitting a complaint is essential for navigating this final stage of the complaints procedure.

Conclusion: Resolving Your African Bank Complaints

Resolving African bank complaints requires patience, persistence, and a clear understanding of the processes involved. By following the steps outlined in this guide and equipping yourself with the necessary information, you can effectively navigate the system and increase your chances of achieving a satisfactory outcome. Remember, knowing your rights and maintaining open communication with the bank are vital for resolving your African bank complaints successfully.

FAQ

- What is the first step in lodging an African bank complaint?

- How long does it typically take for an African bank to respond to a complaint?

- What should I do if my initial complaint is not resolved?

- What is the role of the African Bank Ombudsman?

- What kind of documentation should I gather to support my complaint?

- Can I complain about poor customer service?

- What are some common reasons for African bank complaints?

“Persistence is crucial when dealing with banking complaints,” adds Ms. Fatima Hassan, a consumer rights advocate in South Africa. “Don’t be discouraged if your initial complaint isn’t resolved immediately. Follow the proper channels and escalate the issue as needed.”

Need further assistance? Consider these questions:

- How do I prevent fraudulent activities on my African bank account?

- What are the latest regulations regarding banking practices in Africa?

Explore other helpful articles on our website:

- Understanding African Banking Systems

- Protecting Your Financial Information in Africa

When you need assistance, please contact us: Phone: +255768904061, Email: kaka.mag@gmail.com or visit our office at Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer service team.