Decoding African Bank Financial Statements 2017

The year 2017 marked a significant period for African Bank, as reflected in its financial statements. These documents provide a detailed overview of the bank’s financial health, performance, and strategic direction during that year. For investors, analysts, and anyone interested in the African banking sector, understanding these statements is crucial.

A Deep Dive into African Bank’s 2017 Performance

African Bank’s financial statements for 2017 painted a picture of resilience and growth. Key indicators, such as net interest income and operating expenses, showcased the bank’s ability to navigate the dynamic African market.

African Bank's Financial Performance in 2017

African Bank's Financial Performance in 2017

Analyzing Key Financial Ratios

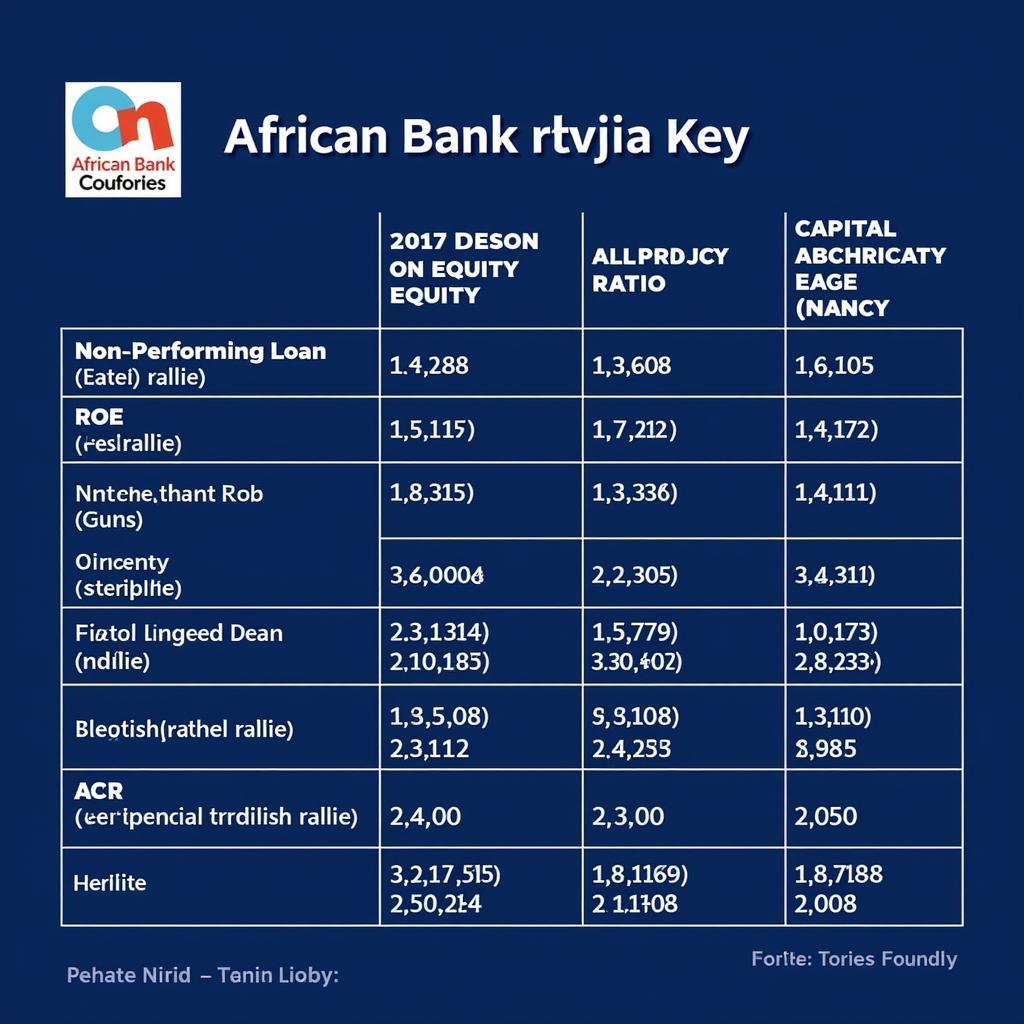

A deeper understanding of African Bank’s 2017 performance can be gained by examining key financial ratios derived from the statements. These ratios provide insights into the bank’s profitability, liquidity, and capital adequacy.

- Return on Equity (ROE): This ratio measures the bank’s profitability by indicating how effectively it utilizes shareholder investments to generate profits.

- Non-Performing Loan (NPL) Ratio: A key indicator of asset quality, the NPL ratio reflects the percentage of loans that are not being repaid as agreed.

- Capital Adequacy Ratio (CAR): This ratio measures the bank’s capital strength and its ability to absorb potential losses.

Key Financial Ratios of African Bank in 2017

Key Financial Ratios of African Bank in 2017

“Analyzing financial ratios in the context of the bank’s operating environment and strategic goals is essential for a comprehensive assessment,” notes Dr. Akindele Adebayo, a financial analyst specializing in African markets.

Strategic Initiatives and Future Outlook

African Bank’s 2017 financial statements also highlighted key strategic initiatives undertaken during that year. These initiatives, such as expanding into new markets and investing in digital banking solutions, were aimed at driving future growth and enhancing customer experience.

Strategic Initiatives of African Bank in 2017

Strategic Initiatives of African Bank in 2017

Conclusion

The 2017 financial statements of African Bank offer valuable insights into the bank’s financial health, performance, and strategic direction during that period. By carefully analyzing these statements, investors and stakeholders can gain a deeper understanding of the bank’s journey and its positioning within the African financial landscape.

FAQs

1. Where can I access the full financial statements of African Bank for 2017?

You can typically find the full financial statements on the African Bank’s official website, usually in the investor relations or financial reporting section.

2. What were the major factors influencing African Bank’s financial performance in 2017?

Several factors could have influenced the bank’s performance, including macroeconomic conditions, interest rate fluctuations, and competition within the African banking sector.

3. How did African Bank’s 2017 performance compare to previous years?

To understand performance trends, it’s crucial to compare the 2017 statements with those of previous years, looking for patterns in key financial indicators.

4. What are some of the potential risks and challenges that African Bank faced in 2017?

Potential risks could include economic volatility in specific African markets, regulatory changes, and increasing competition from both traditional and fintech players.