Understanding African Bank Investments Limited

African Bank Investments Limited (ABIL) is a critical player in South Africa’s financial landscape. This article delves into its history, operations, and impact on the South African economy, providing a comprehensive understanding of ABIL’s role within the broader context of African finance. We will explore its investment strategies, its challenges, and its future prospects.

A Deep Dive into African Bank Investments Limited’s History

ABIL’s story is intricately woven into the fabric of South Africa’s economic evolution. Initially established as a small lending institution, it gradually expanded its operations to become a significant force in the financial sector. This section traces ABIL’s journey from its inception to its present position, highlighting key milestones and transformative periods. The bank’s trajectory reflects the changing dynamics of the South African economy, offering insights into the challenges and opportunities faced by financial institutions in this region. african bank chief says diversification key to zambia's economic renaissance discusses diversification strategies, a relevant topic for understanding ABIL’s growth.

Exploring ABIL’s Investment Portfolio

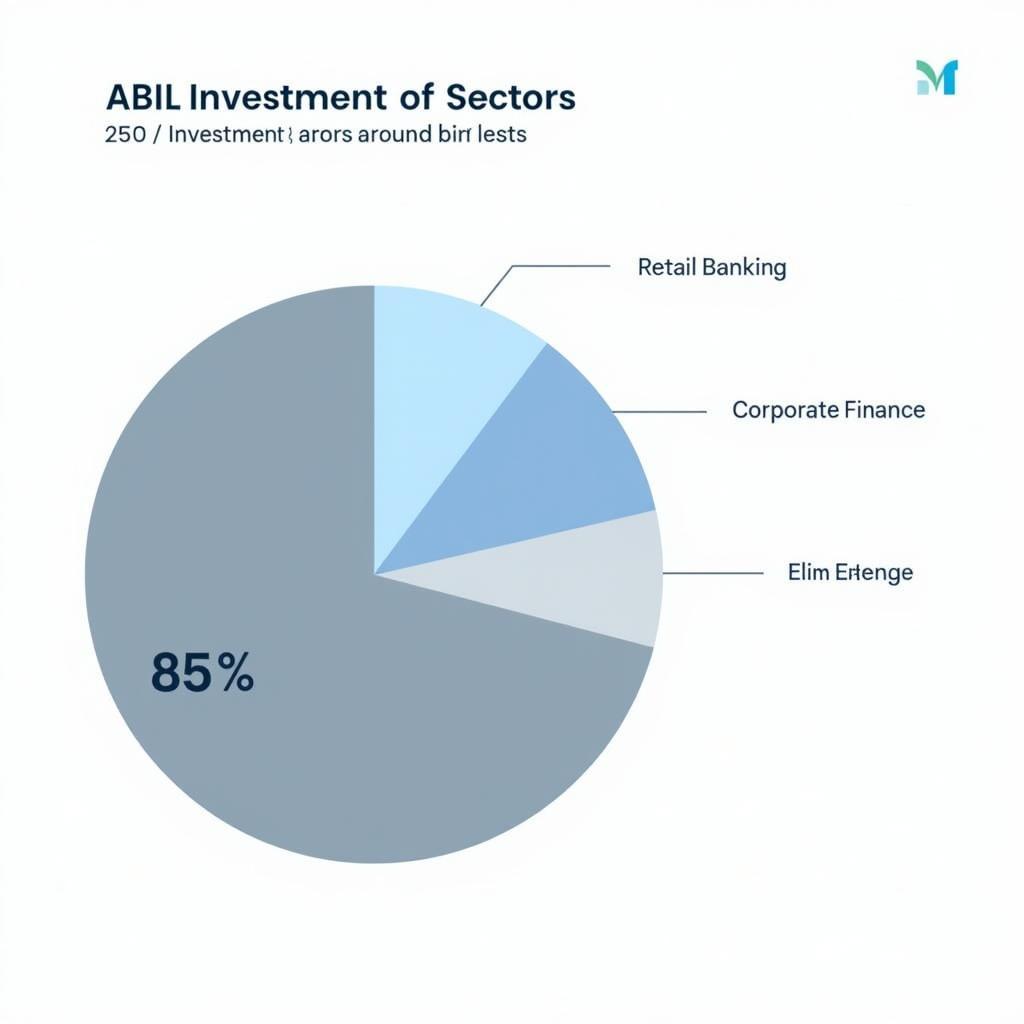

African Bank Investments Limited manages a diverse investment portfolio, focusing on various sectors within the South African economy. This section examines the composition of ABIL’s portfolio, including its investments in retail banking, corporate finance, and other financial services. Understanding the strategic allocation of resources within ABIL’s portfolio provides crucial insights into the bank’s overall financial health and its risk management strategies. This analysis also illuminates the interconnectedness of various economic sectors in South Africa and how ABIL’s investment decisions impact these sectors.

ABIL Investment Portfolio Breakdown

ABIL Investment Portfolio Breakdown

What are ABIL’s primary investment sectors? ABIL primarily invests in retail banking, corporate finance, and other financial services.

Challenges and Opportunities for African Bank Investments Limited

Operating within the dynamic South African economic landscape presents both challenges and opportunities for ABIL. This section explores the key factors influencing the bank’s performance, such as regulatory changes, economic fluctuations, and competitive pressures. Analyzing these external forces is crucial for understanding ABIL’s strategic decision-making and its ability to navigate the complexities of the financial market. Furthermore, this section identifies potential growth areas for ABIL, considering the evolving financial needs of the South African population and the opportunities presented by technological advancements. african bank limited head office provides more context about the company’s structure.

What are the main challenges faced by ABIL? ABIL faces challenges like regulatory changes, economic fluctuations, and competitive pressures.

The Future of ABIL in the African Financial Landscape

African Bank Investments Limited holds a significant position within the broader context of the African financial landscape. This section analyzes ABIL’s role in contributing to the growth and development of the financial sector in South Africa and beyond. It examines the bank’s potential to expand its operations into other African markets and the implications of such expansion for both ABIL and the recipient economies. african alliance investment bank subsidiaries gives further insights into investment structures. african countries in debt distress provides valuable context on the economic landscape ABIL operates within. african fintech buyout fund is an important example of investment trends relevant to ABIL’s future.

ABIL Future Growth Projections

ABIL Future Growth Projections

How does ABIL contribute to the African financial landscape? ABIL contributes to the African financial landscape by providing financial services and fostering economic growth within South Africa and potentially beyond.

In conclusion, African Bank Investments Limited (ABIL) is a key player in the South African financial market. Understanding its history, investment strategies, challenges, and future prospects is essential for grasping the complexities of the African financial landscape. ABIL’s continued success relies on its ability to adapt to the changing economic environment and to capitalize on emerging opportunities.

FAQ

- What is African Bank Investments Limited’s primary business?

- How does ABIL contribute to the South African economy?

- What are the key challenges faced by ABIL?

- What are ABIL’s future growth prospects?

- How does ABIL’s investment portfolio reflect its strategy?

- What is the significance of ABIL in the African financial context?

- How does ABIL manage risk in its investments?

Need support? Contact us 24/7: Phone: +255768904061, Email: kaka.mag@gmail.com, or visit us at Mbarali DC Mawindi, Kangaga, Tanzania.