African Bank Personal Loans Online Application: A Comprehensive Guide

Applying for a personal loan can feel overwhelming, especially when navigating the digital landscape. This guide provides valuable information about African Bank Personal Loans Online Application, making the process smoother and more understandable.

Navigating the world of personal finance can be challenging, and finding the right loan can be a significant hurdle. With the rise of online banking, applying for a personal loan has become more accessible than ever. African Bank is one prominent player in this arena, offering a streamlined online application process for personal loans. This comprehensive guide delves into the intricacies of African Bank personal loans online application, providing you with the necessary knowledge to make informed decisions. Applying for an african bank online loan application in seconds may sound too good to be true, but understanding the process can help you determine if it’s the right choice for your needs.

Understanding African Bank Personal Loans

African Bank offers a range of personal loan options tailored to individual needs. Whether you’re looking to consolidate debt, cover unexpected expenses, or finance a dream purchase, understanding the loan options available is crucial. Key features often include competitive interest rates, flexible repayment terms, and a transparent application process. What sets African Bank apart is their commitment to responsible lending, ensuring borrowers understand the terms and conditions before committing. Knowing your financial standing and borrowing capacity is essential before applying.

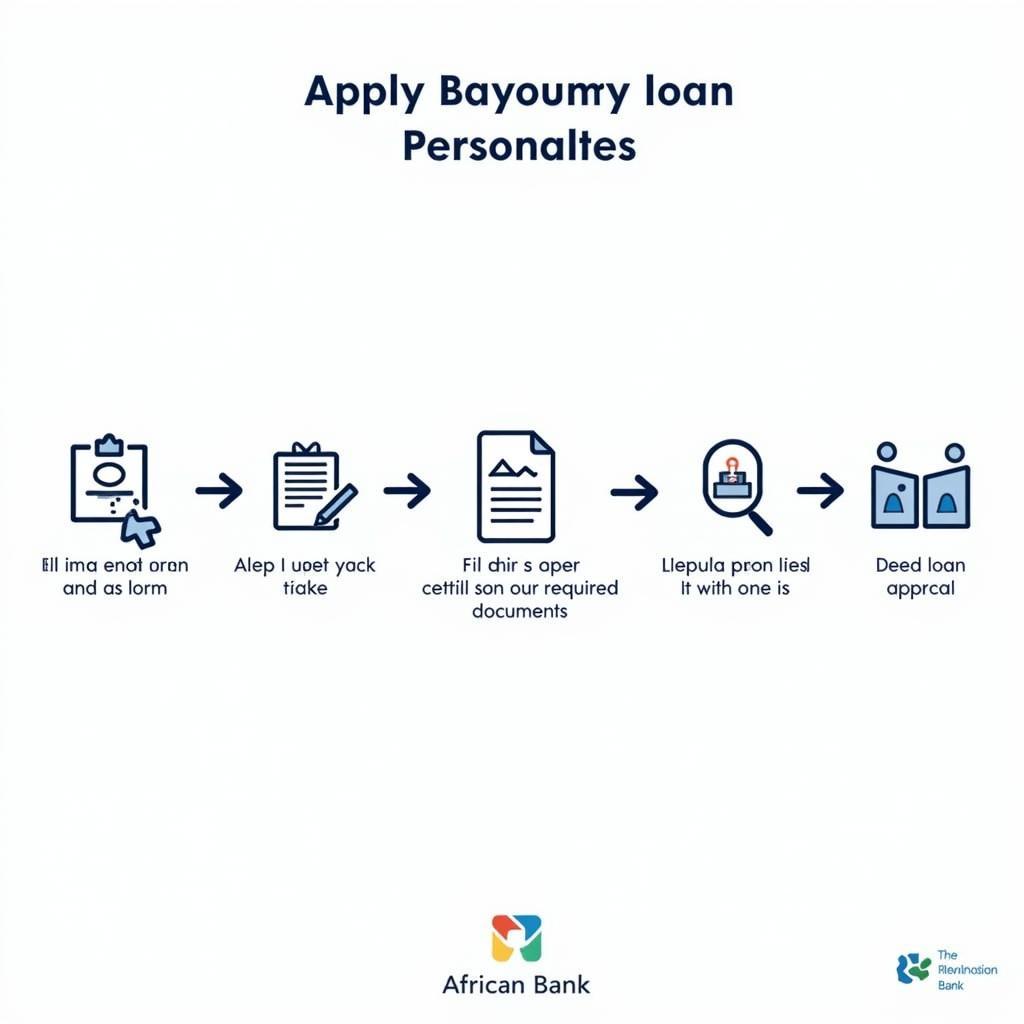

African Bank Personal Loan Application Process

African Bank Personal Loan Application Process

Applying for an African Bank Personal Loan Online: A Step-by-Step Guide

The online application process is designed for convenience and efficiency. Generally, it involves the following steps: creating an online account, completing the application form with accurate personal and financial information, uploading necessary supporting documents, and submitting the application for review. The bank then assesses your eligibility based on various factors, including credit score and income. You can explore more about the application process at african bank.

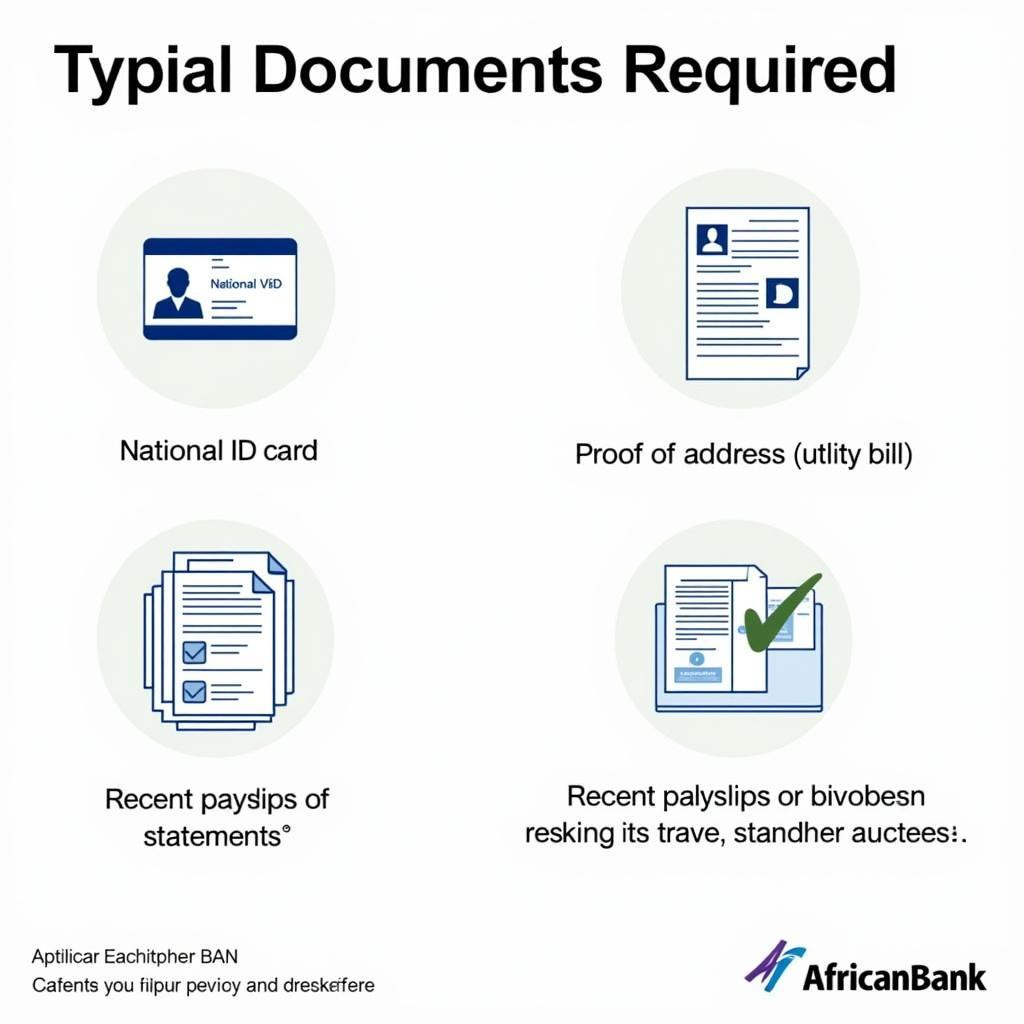

What Documents Do I Need?

Typically, you’ll need proof of identity, address, and income. These might include your ID, recent bank statements, and payslips. Having these prepared beforehand can significantly speed up the application process.

African Bank Required Documents for Loan Application

African Bank Required Documents for Loan Application

Key Considerations Before Applying

Before applying for an African Bank personal loan online application, it’s wise to consider several factors. Evaluate your current financial situation, including your debt-to-income ratio. Review your credit report to understand your creditworthiness and identify any potential issues. It’s also prudent to compare loan options from different lenders to ensure you’re getting the best possible deal. Consider the african bank loans interest rates when making your comparisons.

What if My Loan Application is Declined?

While African Bank strives to make lending accessible, applications can sometimes be declined. Understanding the reasons for decline, like a low credit score or insufficient income, can help you take corrective measures and improve your chances for future applications. For further insight, you can explore information about african bank loan declined.

Managing Your African Bank Personal Loan

Once approved, managing your loan effectively is essential. Make timely repayments to avoid late payment fees and maintain a positive credit history. Utilize online banking tools to track your loan balance and payment schedule. Remember, responsible loan management contributes to your overall financial well-being.

African Bank Loan Management Tools

African Bank Loan Management Tools

Conclusion

The African Bank personal loans online application process provides a convenient avenue for accessing credit. By understanding the process, requirements, and key considerations, you can navigate the application journey with confidence and make informed financial decisions. Applying for an African Bank personal loan online application can be a straightforward process with the right preparation and information. Applying for an african bank online consolidation loan application can be particularly helpful for managing multiple debts.

FAQ

- What is the minimum loan amount I can apply for? This varies depending on the specific loan product.

- How long does the application process take? The online application itself is quick, but approval time may vary.

- Can I apply if I have a low credit score? African Bank assesses applications on a case-by-case basis.

- What are the repayment options? Typically, repayments are made through debit orders or online transfers.

- Can I prepay my loan? Yes, prepayment is often allowed, but check for any associated fees.

Example situations and questions:

- Scenario: A young entrepreneur needs a loan to expand their business. Question: What loan options are suitable for small business growth?

- Scenario: Someone has multiple debts and wants to simplify their finances. Question: How can a consolidation loan help manage multiple debts?

Other helpful articles/questions:

- What are the eligibility criteria for an African Bank personal loan?

- How can I improve my credit score to increase my chances of loan approval?

- What are the long-term implications of taking out a personal loan?

Need Assistance? Contact us at Phone Number: +255768904061, Email: kaka.mag@gmail.com Or visit our office at: Mbarali DC Mawindi, Kangaga, Tanzania. We have a 24/7 customer support team.