Understanding African Currency: A Deep Dive into Kenyan Shillings (Kshs)

The Kenyan shilling (Kshs) is the official currency of Kenya, a vibrant East African nation renowned for its diverse culture, breathtaking landscapes, and thriving economy. Understanding the Kenyan shilling, its history, and its value is crucial for anyone traveling to Kenya or engaging in business within its borders.

A History of the Kenyan Shilling

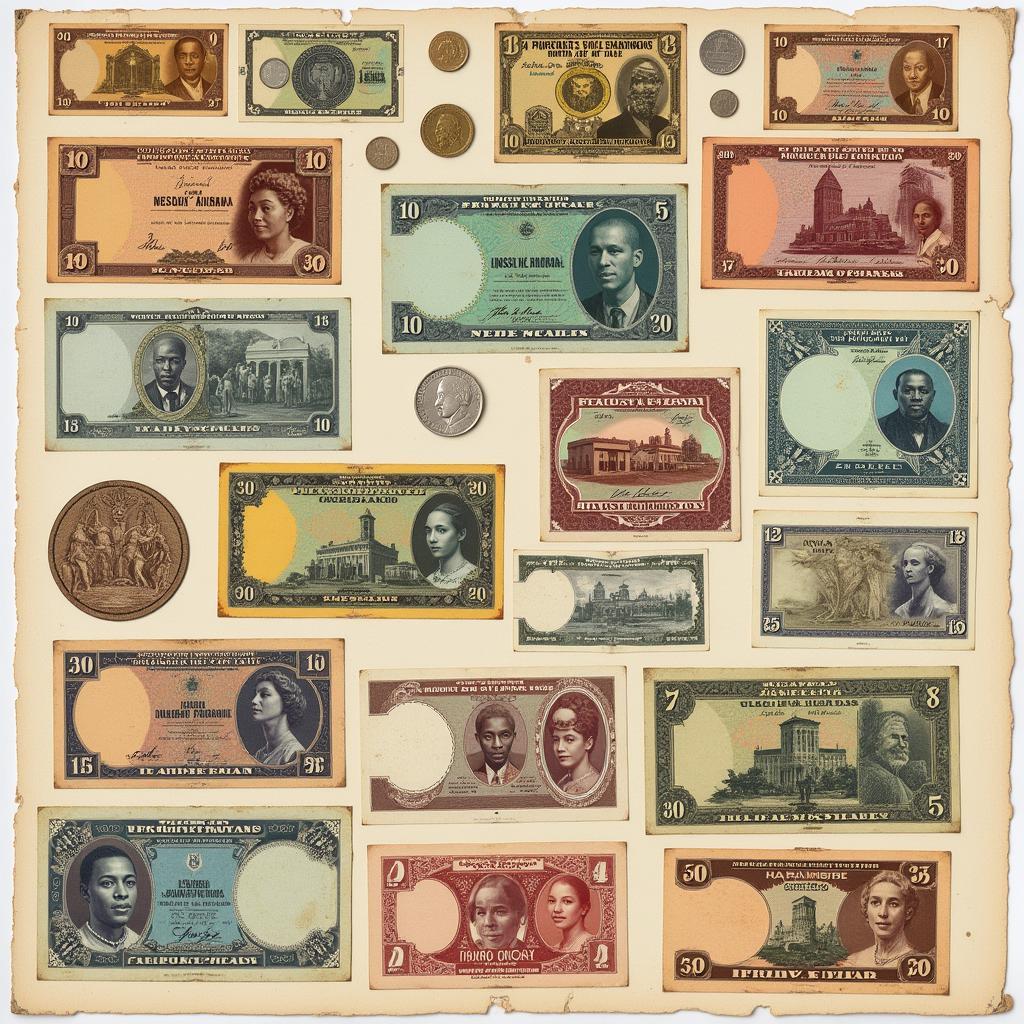

The Kenyan shilling’s journey began in 1966 when it replaced the East African shilling. This transition marked a significant step in Kenya’s post-colonial journey, allowing the nation to establish its own independent monetary system.

Evolution of Kenyan Shilling Banknotes and Coins

Evolution of Kenyan Shilling Banknotes and Coins

Kenyan Shilling Denominations and Exchange Rates

The Kenyan shilling is divided into 100 cents and comes in both banknotes and coins. Banknotes are available in denominations of 50, 100, 200, 500, and 1000 shillings, each featuring distinctive designs that often depict Kenya’s rich wildlife, cultural heritage, and prominent leaders. Coins are available in denominations of 1, 5, 10, and 20 shillings, as well as 50 cents.

The exchange rate of the Kenyan shilling fluctuates against other major currencies based on market forces. As of October 26, 2023, 1 USD is roughly equivalent to 145 Kshs. It’s essential to consult a currency converter or check with your bank for the most up-to-date exchange rate before traveling to Kenya or making any financial transactions.

Factors Influencing the Kenyan Shilling’s Value

Like all currencies, the Kenyan shilling’s value is influenced by a range of economic factors, including:

- Economic Growth: Strong economic performance in Kenya generally strengthens the shilling, attracting foreign investment and boosting confidence in the currency.

- Inflation: High inflation rates can erode the purchasing power of the shilling, potentially leading to depreciation.

- Interest Rates: Changes in interest rates set by the Central Bank of Kenya can impact the flow of capital in and out of the country, influencing the shilling’s value.

Tips for Managing Your Money in Kenya

Navigating a new currency can feel daunting, but with a little preparation, you can manage your money effectively in Kenya.

- Notify Your Bank: Inform your bank about your travel plans to ensure your debit and credit cards will function smoothly in Kenya.

- Carry Small Denominations: Having smaller banknotes and coins readily available is helpful for everyday purchases, especially in more rural areas.

- Negotiate Exchange Rates: When exchanging currency, it’s wise to compare rates from different providers, including banks, ATMs, and reputable exchange bureaus, to secure the most favorable deal.

Bustling Marketplace with Locals and Tourists Exchanging Kenyan Shillings

Bustling Marketplace with Locals and Tourists Exchanging Kenyan Shillings

The Kenyan Shilling in the Digital Age

Kenya has witnessed a surge in mobile money platforms, such as M-Pesa, which have transformed the way Kenyans transact. These platforms allow users to send and receive money, pay bills, and even access microloans conveniently through their mobile phones.

“The widespread adoption of mobile money has undeniably revolutionized financial inclusion in Kenya, empowering individuals who previously lacked access to traditional banking services,” notes Dr. Sarah Wambui, an economist specializing in African financial markets.

Looking Ahead: The Future of the Kenyan Shilling

The Kenyan shilling continues to play a pivotal role in the nation’s economic growth and stability. As Kenya embraces technological advancements and continues its trajectory of development, the shilling is poised to evolve alongside these changes, adapting to the dynamic landscape of global finance.

Understanding the nuances of the Kenyan shilling equips travelers and businesses with the knowledge to navigate the financial landscape confidently, fostering seamless transactions and fostering deeper appreciation for the intricacies of Kenya’s vibrant economy.