Investing in African Government Bonds: A Comprehensive Guide

African Government Bonds are becoming an increasingly attractive investment opportunity for those seeking diversification and potential higher returns. This guide explores the landscape of these bonds, examining the risks and rewards, key considerations for investors, and the potential impact on African economies.

Understanding African Government Bonds

What are African government bonds? They are debt securities issued by African governments to finance public spending. These bonds offer investors a fixed income stream (coupon payments) and the return of principal at maturity. Investing in these bonds allows you to participate in the growth story of the continent while potentially earning a competitive return. You can find more general information on african bonds. Understanding the specific economic and political landscape is crucial for navigating this market.

Assessing Risks and Rewards

Like any investment, African government bonds carry risks. These include currency fluctuations, political instability, and credit risk. However, the potential rewards can be significant. Many African economies are experiencing rapid growth, fueled by a young population, abundant natural resources, and increasing urbanization. This growth translates into higher potential returns for bond investors. It’s important to consider factors like the country’s credit rating, economic outlook, and political stability when evaluating potential investments. Diversifying your portfolio across different African countries can help mitigate risk.

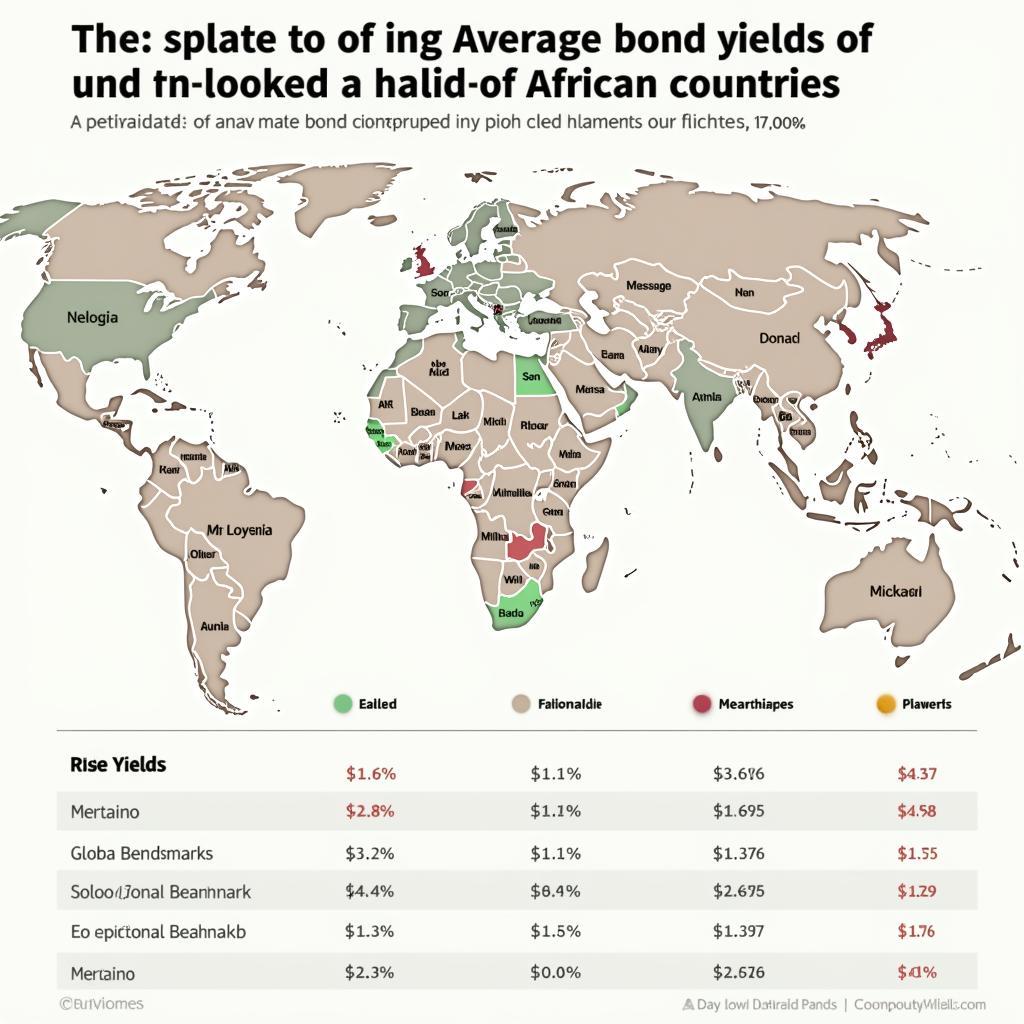

African Government Bond Yields and Returns

African Government Bond Yields and Returns

Key Considerations for Investors

Before investing in African government bonds, it’s essential to do your research. Consider the following:

- Creditworthiness of the Issuer: Assess the country’s credit rating and its ability to repay its debt obligations.

- Currency Risk: Fluctuations in exchange rates can impact your returns.

- Interest Rate Environment: Understand the prevailing interest rate environment and its potential impact on bond prices.

- Liquidity: Ensure there is sufficient liquidity in the market to buy and sell bonds easily.

Understanding these factors will help you make informed investment decisions. It’s also valuable to consult with a financial advisor who specializes in emerging markets.

Impact on African Economies

Investment in african bonds can significantly impact African economies. It provides governments with much-needed capital to finance infrastructure projects, improve healthcare and education, and support economic development. This influx of capital can create jobs, boost economic growth, and improve living standards.

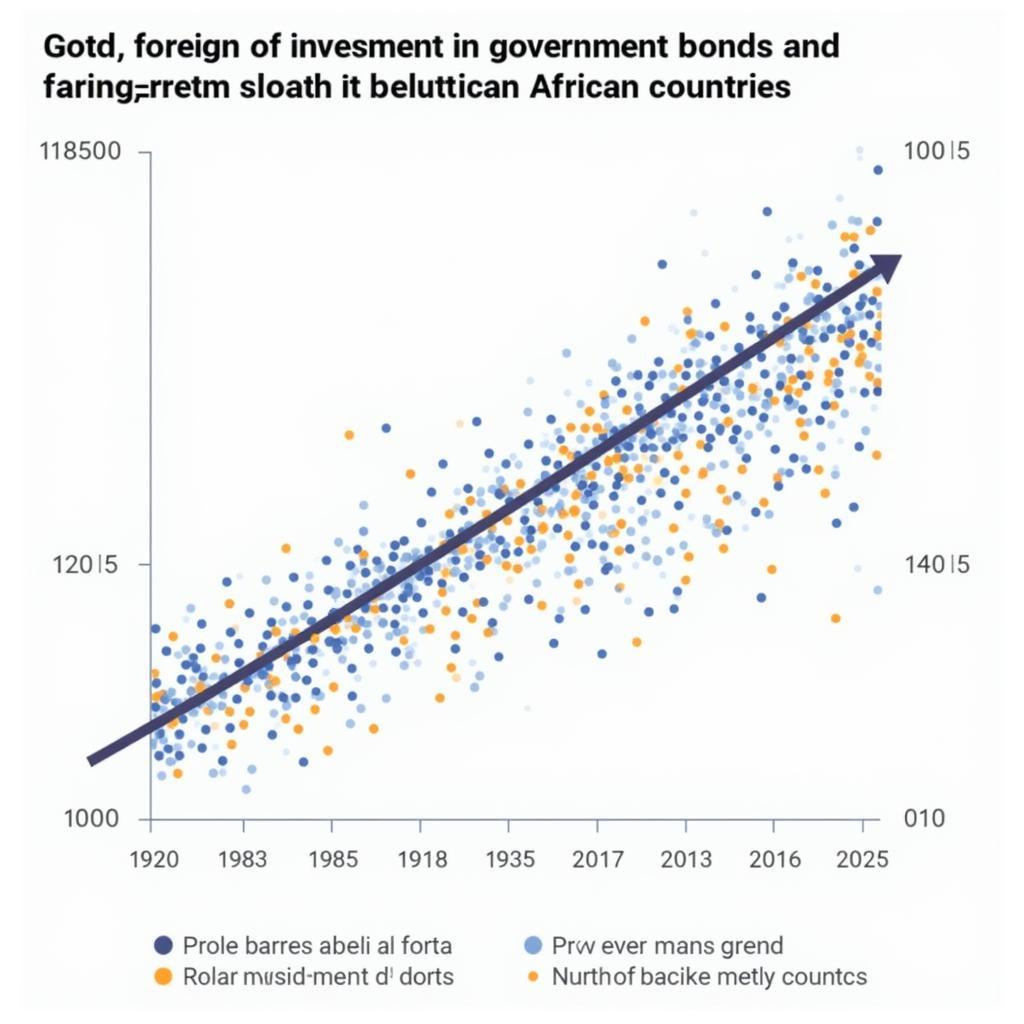

Impact of Bond Investment on African Economies

Impact of Bond Investment on African Economies

Navigating the African Bond Market

Investing in African government bonds requires a strategic approach. Consider working with a financial advisor who has expertise in emerging markets. They can help you navigate the complexities of the market and identify suitable investment opportunities. They can also provide guidance on managing risks and maximizing returns. Further research on financial institutions with african bank branches near me could prove beneficial to potential investors.

Conclusion

African government bonds offer a unique investment opportunity with the potential for high returns while contributing to the growth of African economies. By carefully assessing the risks and rewards, conducting thorough research, and seeking expert advice, investors can effectively navigate this exciting market and potentially achieve their financial goals. Investing in African government bonds offers a chance to participate in the dynamic growth story of the continent.

FAQs

- What are the typical maturities of African government bonds?

- How can I access information on African bond yields and prices?

- What are the tax implications of investing in African government bonds?

- Are there any specific regulations for foreign investors in African bond markets?

- What are some of the best-performing African government bonds in recent years?

- How can I diversify my portfolio across different African countries?

- What are the key economic indicators to watch when investing in African bonds?

What are the most common African government bonds?

Most African governments issue bonds in their local currencies and in US dollars. Some common bonds include:

- Eurobonds: These are bonds denominated in a currency other than the issuer’s domestic currency.

- Treasury bills: These are short-term securities with maturities of less than one year.

- Treasury bonds: These are long-term securities with maturities of more than ten years.

- Infrastructure bonds: These are bonds issued specifically to finance infrastructure projects.

What factors should I consider before investing in African government bonds?

Before investing in african bonds, you should consider the following factors:

- The country’s credit rating: The higher the credit rating, the lower the risk of default.

- The country’s economic outlook: A strong economy is more likely to be able to repay its debts.

- The political stability of the country: Political instability can lead to currency fluctuations and increased risk.

- The interest rate environment: Rising interest rates can lead to lower bond prices.

- The liquidity of the market: A liquid market means you can easily buy and sell bonds.

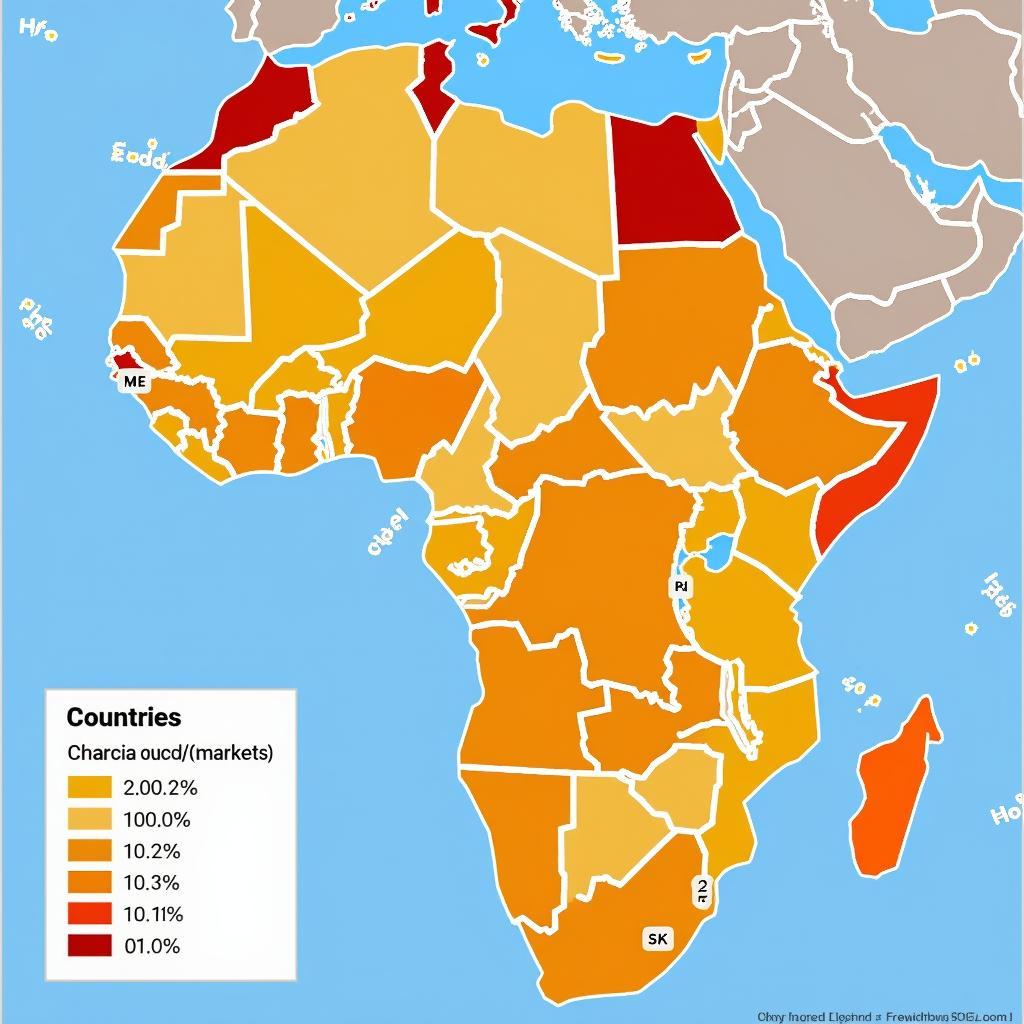

Overview of the African Bond Market

Overview of the African Bond Market

Need more help?

For further assistance, please contact us at Phone: +255768904061, Email: kaka.mag@gmail.com or visit our office at Mbarali DC Mawindi, Kangaga, Tanzania. Our customer service team is available 24/7. You might also find helpful resources on the African desert elephant and the African antelope adda on our website. Explore the fascinating African bush elephant animals as well.