African Banking Corporation Tanzania Limited: A Comprehensive Overview

African Banking Corporation Tanzania Limited is a significant player in Tanzania’s financial landscape. This article will delve into its history, services, and impact on the Tanzanian economy, providing valuable insights for individuals and businesses interested in the banking sector in East Africa.

Understanding African Banking Corporation Tanzania Limited

African Banking Corporation Tanzania Limited offers a range of financial products and services tailored to the needs of various customer segments. From personal banking solutions like checking and savings accounts to corporate banking services such as trade finance and treasury management, the bank strives to cater to a diverse clientele. This commitment to comprehensive financial solutions makes it an important institution within Tanzania’s economic growth. You can learn more about opportunities in other regions like those offered by the african banking corporation of botswana limited.

Services Offered by African Banking Corporation Tanzania Limited

The bank’s extensive service portfolio includes:

- Retail Banking: Providing everyday banking services to individuals, including account management, loans, and mortgages.

- Corporate Banking: Offering specialized financial solutions to businesses, facilitating trade and investment activities.

- Investment Banking: Providing advisory services on mergers and acquisitions, capital markets, and other financial transactions.

- Treasury Management: Helping businesses manage their cash flow and optimize their financial resources.

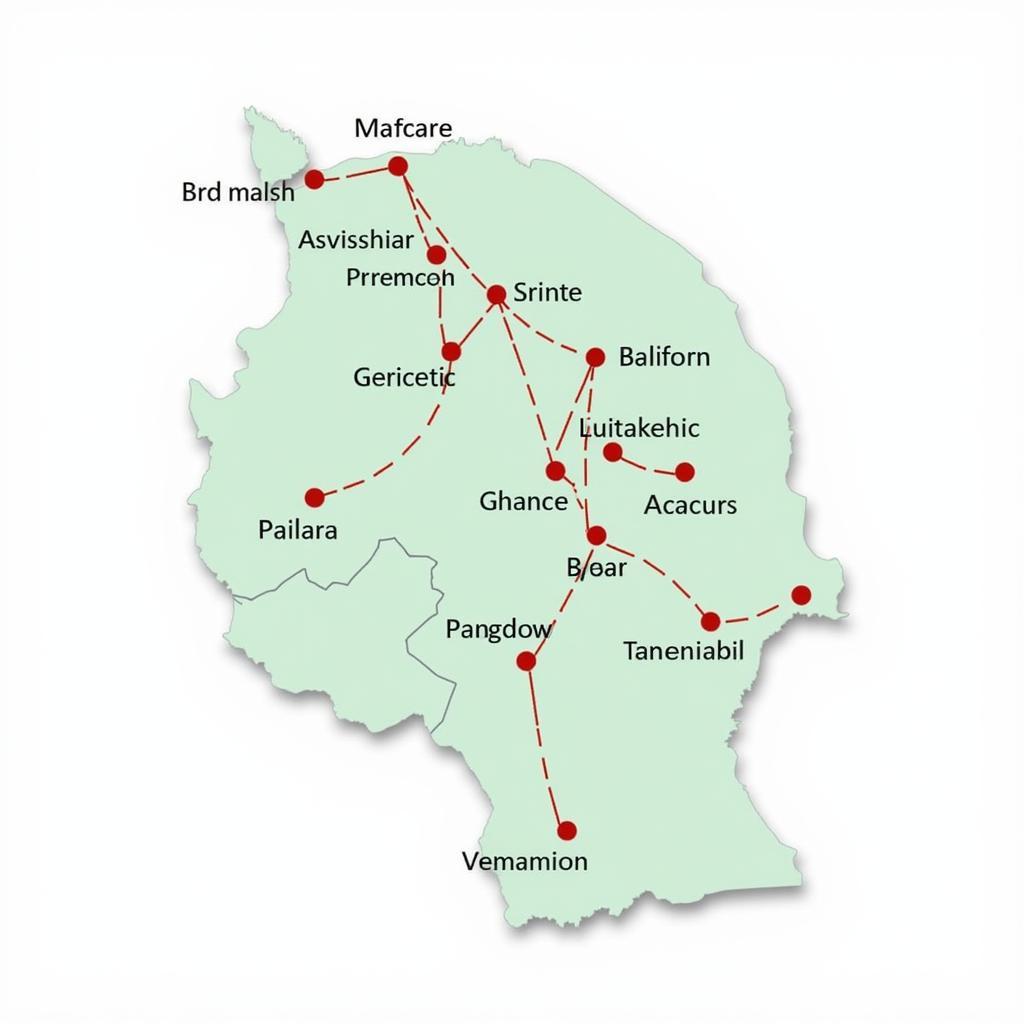

African Banking Corporation Tanzania Limited Branch Network

African Banking Corporation Tanzania Limited Branch Network

The Role of African Banking Corporation Tanzania Limited in Tanzania’s Economy

African Banking Corporation Tanzania Limited plays a crucial role in fostering economic growth and development in Tanzania. By providing access to finance for businesses and individuals, the bank empowers entrepreneurship, promotes investment, and contributes to job creation. The bank also supports key sectors such as agriculture, manufacturing, and tourism, further strengthening Tanzania’s economic diversification. It is worth exploring other career paths in the banking sector, such as african bank careers.

Impact on Local Communities

Beyond its core banking operations, African Banking Corporation Tanzania Limited actively engages in community development initiatives. These programs focus on areas like education, healthcare, and financial literacy, aiming to create positive social impact and improve the lives of Tanzanians. Explore banking options available in South Africa, for example, absa group limited south african banks.

What are the loan options available at African Banking Corporation Tanzania Limited?

African Banking Corporation Tanzania Limited provides various loan options tailored to different customer needs, including personal loans, business loans, and mortgage loans. They offer competitive interest rates and flexible repayment terms, striving to meet the diverse financial requirements of their customers. You can also compare different financial products, like the african bank fixed deposit offered by other institutions.

How to open an account with African Banking Corporation Tanzania Limited?

Opening an account is straightforward. Visit any branch with your identification documents and complete the required application forms. Alternatively, you can apply online through their website. The bank’s customer service team is available to guide you through the process.

Conclusion

African Banking Corporation Tanzania Limited continues to play a vital role in Tanzania’s financial ecosystem. Its wide array of services, commitment to community development, and focus on customer needs solidify its position as a key player in the banking sector. The bank’s efforts contribute significantly to the economic progress of the nation. If you are interested in exploring other banking options in South Africa, you can research institutions such as african bank co za. Understanding the services and impact of institutions like African Banking Corporation Tanzania Limited is essential for navigating the financial landscape in East Africa.

FAQ

-

What are the operating hours of African Banking Corporation Tanzania Limited branches? Most branches operate from 8:30 AM to 4:00 PM on weekdays and 9:00 AM to 12:00 PM on Saturdays.

-

Does African Banking Corporation Tanzania Limited offer internet banking services? Yes, the bank provides a secure and convenient online banking platform for customers to manage their accounts and transactions.

-

How can I contact customer support for assistance? You can contact customer support through their dedicated hotline, email address, or by visiting any branch.

-

What documents are required to open a business account? Generally, you will need to provide business registration documents, director identification, and proof of address.

-

Does the bank offer financial advisory services? Yes, African Banking Corporation Tanzania Limited provides financial advisory services to both individual and corporate clients.

-

What are the eligibility criteria for obtaining a loan? Loan eligibility criteria vary depending on the type of loan and individual circumstances. Contact the bank for specific details.

-

Does African Banking Corporation Tanzania Limited have ATMs across Tanzania? Yes, the bank maintains a network of ATMs across the country for convenient access to cash.

For further support, please contact us at Phone Number: +255768904061, Email: [email protected], or visit our office at Mbarali DC Mawindi, Kangaga, Tanzania. Our customer service team is available 24/7 to assist you.