Exploring African Currency Strength

African Currency Strength is a complex and fascinating topic, influenced by a myriad of factors ranging from global commodity prices to internal political stability. Understanding these dynamics is crucial for anyone interested in investing in, trading with, or simply learning more about the diverse economies of this vast continent. Let’s delve into the forces shaping the strength of African currencies and explore what the future might hold.

After independence, many African nations pegged their currencies to major global currencies like the US dollar or the French franc. While providing initial stability, this often hindered economic growth and responsiveness to local market conditions. Today, a move towards greater currency independence is underway, with varying degrees of success. For example, some countries have adopted floating exchange rates, allowing market forces to determine their currency’s value, while others maintain managed floats, allowing for government intervention when necessary. This shift presents both opportunities and challenges for African economies. You can learn more about how some African economies are performing relative to others by reviewing the GDP of key African cities. See more at African cities by GDP.

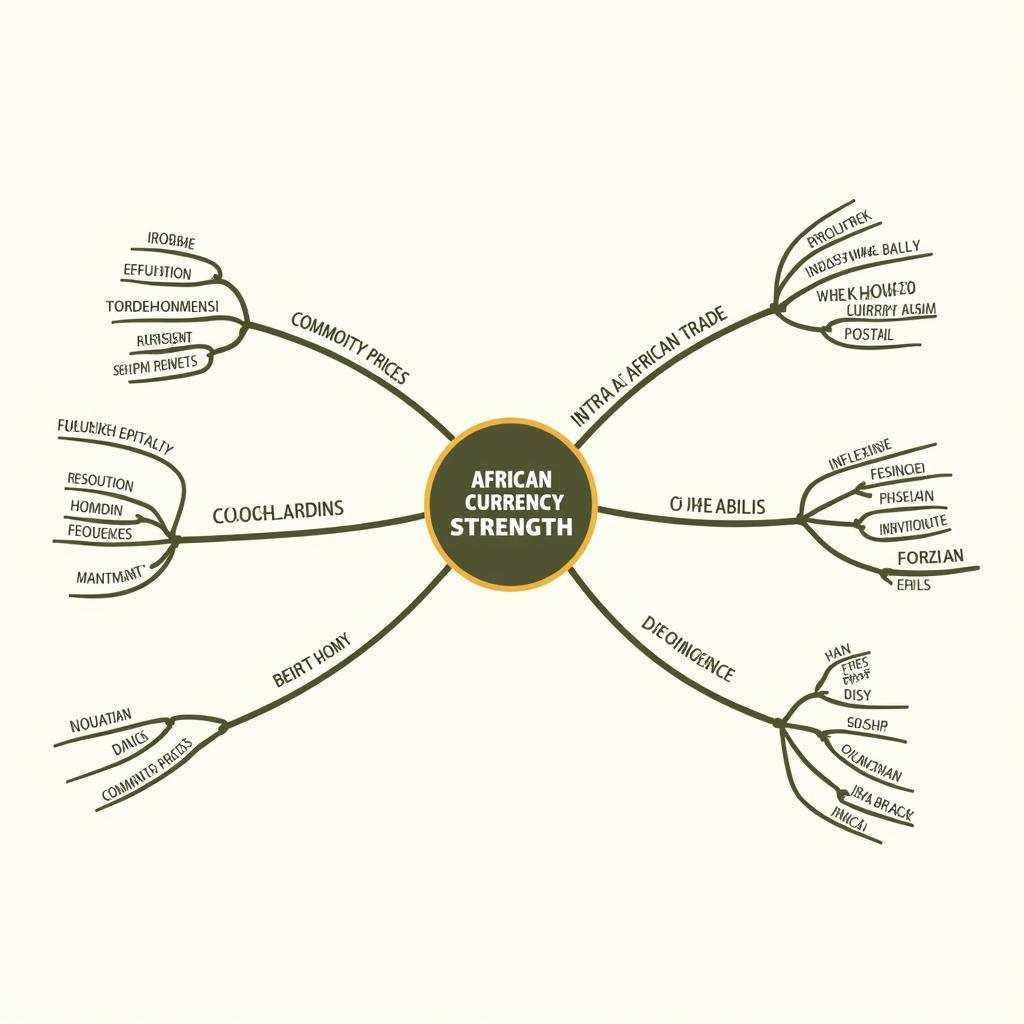

Factors Influencing African Currency Strength

Several key factors contribute to the fluctuations and overall strength of African currencies.

Commodity Dependence

Many African economies rely heavily on exporting raw commodities like oil, minerals, and agricultural products. This dependence makes their currencies susceptible to global price volatility. When commodity prices are high, currencies tend to strengthen; when prices drop, they weaken. Diversifying economies and adding value to exports are crucial steps towards greater currency stability.

Political Stability and Governance

Political instability, corruption, and weak governance can significantly undermine investor confidence and negatively impact currency strength. A stable political environment and transparent governance are essential for attracting foreign investment and fostering economic growth, both of which contribute to a stronger currency. For instance, improvements in ease of doing business rankings often correlate with positive currency movements. Find out more about the ease of doing business in various African countries. Check out African countries ease of doing business.

Inflation and Monetary Policy

High inflation erodes the purchasing power of a currency, leading to depreciation. Central banks play a vital role in managing inflation through monetary policy tools such as interest rate adjustments and controlling the money supply. Effective monetary policies are crucial for maintaining currency stability and promoting economic growth.

African Currency and Commodity Dependence

African Currency and Commodity Dependence

Foreign Investment and Debt

Foreign direct investment (FDI) can boost a country’s foreign exchange reserves and strengthen its currency. However, high levels of external debt, particularly in foreign currencies, can create a burden on the economy and weaken the currency. Managing debt levels sustainably is critical for long-term currency stability. If you are interested in understanding how African currencies relate to other global currencies, you can find more information on the conversion rates between African currencies and the Indian Rupee. For example, you could look at the African currency in rupees.

What Does the Future Hold for African Currencies?

The future of African currency strength is tied to the continent’s economic development and integration into the global economy. Increased intra-African trade, infrastructure development, and diversification away from commodity dependence are essential for fostering stronger and more resilient currencies. Further, technological advancements, particularly in the fintech sector, are creating new opportunities for cross-border transactions and currency management, potentially contributing to greater stability and efficiency in African currency markets.

How does political stability affect African currency?

Political instability weakens investor confidence, leading to capital flight and currency depreciation.

Dr. Adebayo Akinsanya, a renowned economist specializing in African markets, states, “The future of African currencies hinges on the ability of African nations to build resilient and diversified economies.” He adds, “Investing in human capital, fostering innovation, and promoting good governance are key to achieving sustainable economic growth and currency strength.” This view is echoed by many experts, emphasizing the importance of long-term structural reforms for enhancing African currency strength. You can also see the specific conversion rate between the Indian Rupee and the South African Rand by looking at 1 INR to South African Rand.

Conclusion

African currency strength is a dynamic and multifaceted issue shaped by various internal and external factors. While commodity dependence and political instability pose challenges, there are also significant opportunities for growth and development. By embracing diversification, promoting good governance, and fostering innovation, African nations can strengthen their currencies and build more resilient economies. Understanding these dynamics is crucial for navigating the evolving landscape of African finance and making informed investment decisions. The continent’s economic future is intrinsically linked to the strength and stability of its currencies. Understanding and addressing the factors influencing African currency strength is paramount for sustained growth and prosperity. It is also worth considering larger sums of currency for comparison, such as 3000 South African Rand to INR.

Factors Affecting African Currency Strength

Factors Affecting African Currency Strength

FAQ

- What are the main factors affecting African currency strength? Commodity prices, political stability, inflation, and foreign investment are key factors.

- How does commodity dependence impact African currencies? Fluctuations in global commodity prices can significantly impact currency values.

- What role does political stability play in currency strength? Political instability can weaken investor confidence and lead to currency depreciation.

- How can African countries strengthen their currencies? Diversification, good governance, and fostering innovation are crucial strategies.

- What is the future outlook for African currencies? The future depends on economic development, integration, and structural reforms.

- What role does the Central Bank play in currency stability? The Central Bank manages inflation and monetary policy to influence currency stability.

- How does foreign debt impact African currencies? High levels of external debt can weaken a country’s currency.

If you need support, please contact us 24/7: Phone: +255768904061, Email: [email protected], or visit us at Mbarali DC Mawindi, Kangaga, Tanzania.